Top Budgeting Apps: The Best Tools to Manage Your Finances in 2025

In today’s fast-paced world, managing your finances effectively is crucial for financial stability and growth. Budgeting apps are one of the most effective ways to track your spending, save money, and plan for the future. This guide explores the top budgeting apps of 2025, offering features that cater to different needs, from simple expense tracking to complex financial planning.

Why Budgeting Apps Are Essential for Financial Success

Budgeting apps allow users to take control of their finances by tracking expenses, setting goals, and planning for both short- and long-term financial needs. They are more than just tools for keeping track of your spending; they can also offer insights into your financial habits and help you make smarter decisions with your money.

Key Benefits of Using Budgeting Apps:

-

Convenience: Access your budget anytime, anywhere on your smartphone or computer.

-

Easy Tracking: Automatically categorize expenses and income.

-

Goal Setting: Set and track financial goals like saving for a vacation, paying off debt, or building an emergency fund.

-

Financial Insights: Get visual reports and breakdowns of your spending habits.

Top Budgeting Apps for 2025

Here’s a list of the best budgeting apps available today. Each one comes with unique features that cater to specific needs, from beginners to more advanced users.

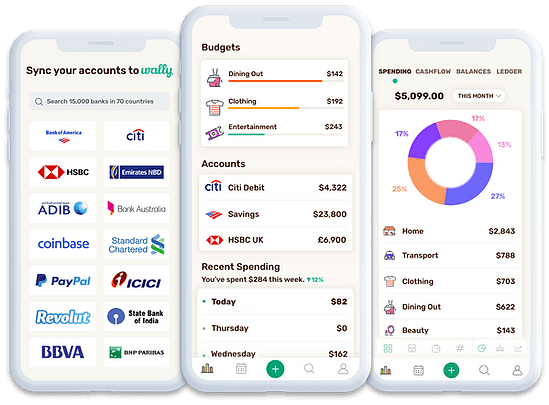

1. Mint: Comprehensive Budgeting and Financial Tracking

Mint is one of the most popular budgeting apps, offering users a comprehensive tool for budgeting, tracking spending, and managing bills. It syncs with your bank accounts, credit cards, and investment accounts to provide real-time updates on your finances.

Features of Mint:

-

Automatic Transactions: Tracks all transactions automatically and categorizes them.

-

Bill Payment Reminders: Helps ensure you never miss a bill payment.

-

Credit Score Monitoring: Gives users free access to their credit score.

-

Investment Tracking: Lets you monitor your investment portfolios alongside your budgeting.

Mint’s integration with various financial accounts makes it ideal for users looking for a one-stop solution to manage all their finances. Learn more about Mint.

2. YNAB (You Need a Budget): A Goal-Oriented Budgeting App

YNAB focuses on helping users allocate money to specific goals and giving them the tools to prioritize savings, pay down debt, and build wealth. Unlike many other budgeting apps, YNAB emphasizes a zero-based budgeting approach, where every dollar is assigned a task.

Features of YNAB:

-

Zero-Based Budgeting: Helps you assign every dollar to a specific goal.

-

Goal Tracking: Set and track progress toward savings, debt repayment, or other financial goals.

-

Educational Resources: Offers training and support to help users master budgeting.

-

Syncs with Banks: Automatically syncs with your bank accounts for real-time updates.

YNAB is a great choice for users who are serious about managing their finances and sticking to a disciplined budget. Check out more about YNAB.

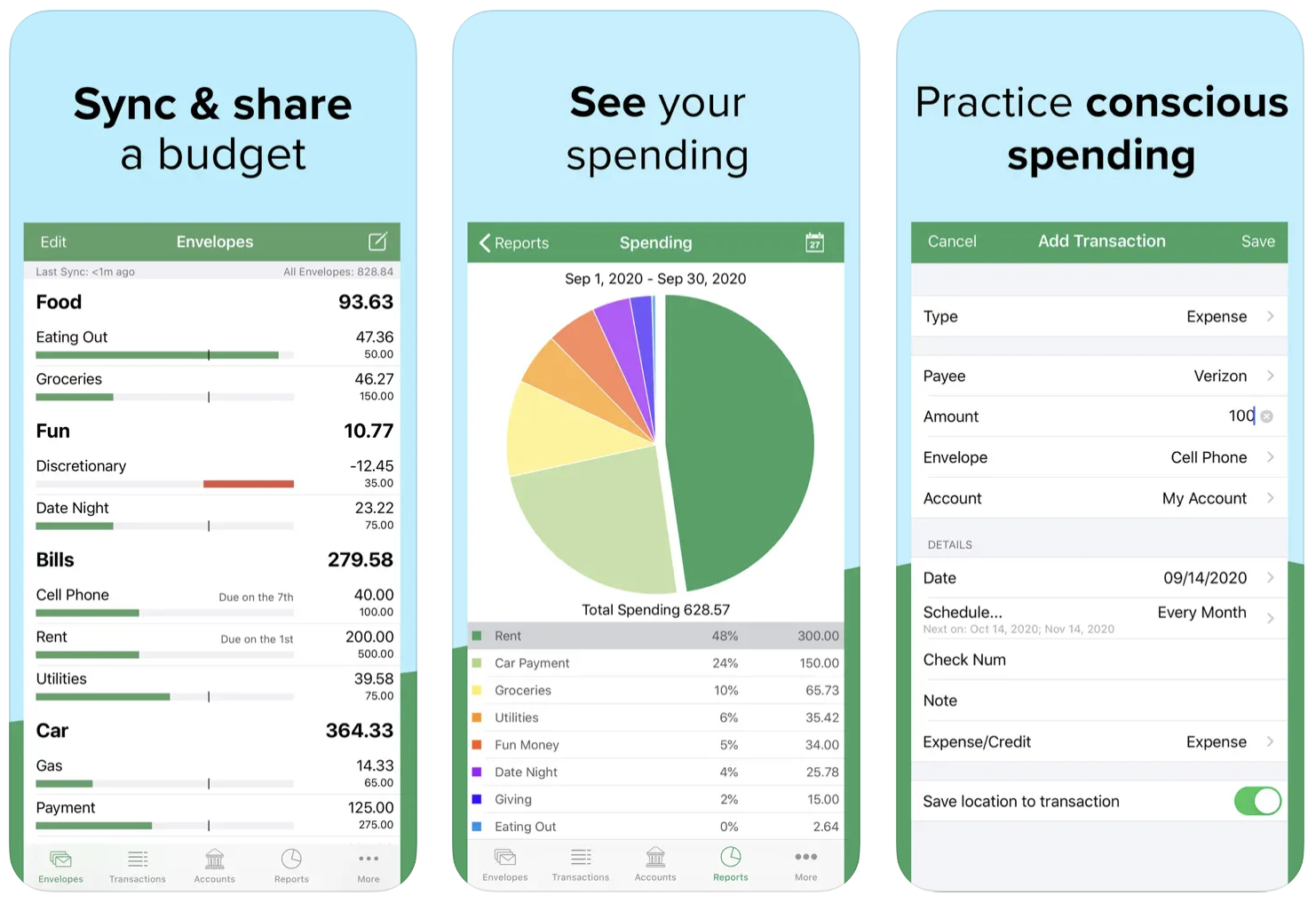

3. Goodbudget: Envelope-Based Budgeting

Goodbudget is a digital envelope budgeting app that allows users to set up envelopes for different spending categories. It’s ideal for individuals who prefer the traditional method of budgeting using physical envelopes, but with the convenience of a smartphone app.

Features of Goodbudget:

-

Envelope Budgeting: Allocate money to different envelopes, ensuring you stick to your budget.

-

Multiple Devices: Sync across multiple devices, allowing family members to access the same budget.

-

Debt Tracking: Helps users track debt payments and progress.

-

Track Transactions: Manually enter transactions and reconcile them with your budget.

If you like the envelope system but need something more modern, Goodbudget might be perfect. Explore Goodbudget.

4. PocketGuard: Easy-to-Use Budgeting with a Focus on Savings

PocketGuard is designed to make budgeting as simple as possible. It tracks your income, bills, and subscriptions, then tells you how much “pocket” money you have left after covering your essential expenses.

Features of PocketGuard:

-

Easy-to-Understand Dashboard: See your available funds at a glance.

-

Track Subscriptions: Automatically tracks your subscriptions and helps you identify savings opportunities.

-

Automatic Categorization: Automatically categorizes your spending for easy tracking.

-

Set Savings Goals: Allows you to set up specific savings goals and track progress.

With its straightforward approach, PocketGuard is ideal for users who prefer simplicity and transparency. Learn more about PocketGuard by visiting PocketGuard.

5. EveryDollar: Simple and Straightforward Budgeting

Created by financial expert Dave Ramsey, EveryDollar is a budgeting app that follows the zero-based budgeting method, allowing users to plan and track their monthly expenses easily. It offers both a free version and a premium version with additional features.

Features of EveryDollar:

-

Zero-Based Budgeting: Allocate every dollar to a specific category.

-

Expense Tracking: Enter and track your expenses manually or sync with bank accounts (in the premium version).

-

Financial Goal Setting: Create financial goals and monitor your progress.

-

Simple Interface: Offers an easy-to-use interface for quick budgeting.

If you prefer a simple approach with a focus on monthly budgeting, EveryDollar is an excellent choice. Check out EveryDollar.

How to Choose the Right Budgeting App for You

With so many options available, it can be difficult to choose the best budgeting app for your needs. Here are a few factors to consider when making your decision:

1. Ease of Use

Look for an app with an intuitive and simple interface. If you’re new to budgeting, you might want an app that’s easy to navigate without too many features that could overwhelm you.

2. Features

Determine which features are most important for you. Do you want an app that tracks investments or one that helps you plan for savings? Make sure the app has features that suit your needs.

3. Cost

Some apps are free, while others offer premium features for a subscription fee. Compare the features offered in free and paid versions to decide what works best for your budget.

4. Syncing Capabilities

Check whether the app allows syncing across devices and financial accounts. This is crucial if you want to track your finances in real time and on multiple devices.

Frequently Asked Questions (FAQs)

1. Are Budgeting Apps Safe to Use?

Yes, most budgeting apps use encryption and other security measures to protect your financial data. Always read the app’s privacy policy and ensure it follows industry standards for data protection.

2. Can I Use Budgeting Apps for Both Personal and Business Finances?

While some budgeting apps are designed primarily for personal use, others offer features that cater to business finances as well. Make sure to choose an app that aligns with your needs.

3. Do I Need to Link My Bank Account to a Budgeting App?

While it’s not mandatory, linking your bank account allows for automatic transaction tracking, making budgeting more efficient. Some apps, like Mint and YNAB, require this to sync your financial data.

Conclusion

Whether you’re looking to track your spending, pay off debt, or save for future goals, the right budgeting app can be a game-changer. The apps listed here, including Mint, YNAB, Goodbudget, PocketGuard, and EveryDollar, offer a range of features to suit different financial needs. By carefully considering your preferences and financial goals, you can find the best tool to manage your money effectively.

Start your budgeting journey today by exploring these apps:

Choose the app that best suits your needs, and take control of your financial future!