Personal Finance Tools: A Guide to Managing Your Money in 2025

Managing your finances can feel overwhelming at times, but with the right personal finance tools, you can take control of your budget, investments, and savings. These tools help you track expenses, set financial goals, and make informed decisions about your money. Whether you’re saving for a big purchase or planning for retirement, the right tools can streamline the process and make financial management easier.

Why You Need Personal Finance Tools

Personal finance tools are essential for anyone who wants to keep their financial life organized and optimized. They help you track your spending, create budgets, set savings goals, and monitor investments—all in one place. With the right tools, you can:

-

Improve Financial Literacy: Gain a deeper understanding of your spending habits and financial patterns.

-

Track Your Expenses: Know exactly where your money is going each month.

-

Set and Achieve Financial Goals: Whether you’re saving for a vacation, paying off debt, or investing for the future, these tools help you track your progress.

By using personal finance tools, you can make smarter decisions that align with your financial goals.

Top Personal Finance Tools to Try in 2025

1. Mint: A Comprehensive Budgeting Tool

Mint is one of the most popular personal finance tools available today. It offers a simple way to track your spending, create budgets, and monitor your credit score. With Mint, you can connect all of your financial accounts in one place, including bank accounts, credit cards, loans, and investments.

Why Choose Mint?

-

Easy to Use: Mint provides an intuitive dashboard that shows you an overview of your finances.

-

Automatic Categorization: Mint automatically categorizes your transactions, making it easier to see where your money goes.

-

Free to Use: Mint is completely free, making it accessible to everyone.

Learn more about Mint’s features

2. YNAB (You Need a Budget)

For those looking to take a more hands-on approach to budgeting, YNAB is a fantastic option. YNAB helps you create a zero-based budget, meaning you give every dollar a job, whether it’s for savings, debt repayment, or expenses. It’s an ideal tool for people who want to be more intentional about their spending.

Why Choose YNAB?

-

Goal-Oriented: YNAB focuses on helping you achieve financial goals, such as paying off debt or saving for a specific purpose.

-

Comprehensive Education: YNAB provides resources and support to help you learn better budgeting habits.

-

Syncing Across Devices: Your budget syncs across devices, so you can manage your finances anywhere.

3. Personal Capital: Investment and Retirement Planning

Personal Capital combines both budgeting and investment tracking in one powerful tool. It’s perfect for those who want to monitor their spending habits while also keeping an eye on their retirement goals. Personal Capital helps you plan for the future by showing you an overview of your net worth and investment accounts.

Why Choose Personal Capital?

-

Retirement Planning: Personal Capital offers detailed retirement planning tools to ensure you’re on track.

-

Investment Tracking: See how your investments are performing and get actionable insights.

-

Free Version Available: While Personal Capital offers premium services, the basic version is free and offers robust features.

4. PocketGuard: Keep Track of Spending

PocketGuard simplifies budgeting by helping you track your spending and ensuring that you don’t go over your budget. It’s a great tool for individuals who want a straightforward way to manage their finances without getting bogged down by complex features.

Why Choose PocketGuard?

-

Easy Expense Tracking: PocketGuard automatically categorizes your transactions and lets you see how much disposable income you have left each month.

-

Debt Management: You can also use PocketGuard to track credit card payments and ensure you’re making progress on paying off debt.

-

Security: PocketGuard uses top-notch encryption to keep your financial information safe.

5. FasterCapital: A Tool for Wealth Growth

FasterCapital offers a unique perspective on personal finance tools by focusing on wealth growth. It’s a great tool for those looking to expand their savings or build wealth over time, particularly for entrepreneurs and small businesses.

Why Choose FasterCapital?

-

Wealth-Building Tools: It offers tools to help individuals grow their wealth through investments and savings.

-

Detailed Analytics: Get detailed insights into your financial habits and learn how to make better financial decisions.

-

Tailored for Entrepreneurs: If you’re running a business, this tool helps you manage both personal and business finances.

Key Features to Look for in Personal Finance Tools

When choosing the right personal finance tool, consider the following features to ensure you get the most out of your tool:

1. Security

Your financial data is sensitive, so ensure that the tool you choose has robust security measures, including encryption and two-factor authentication.

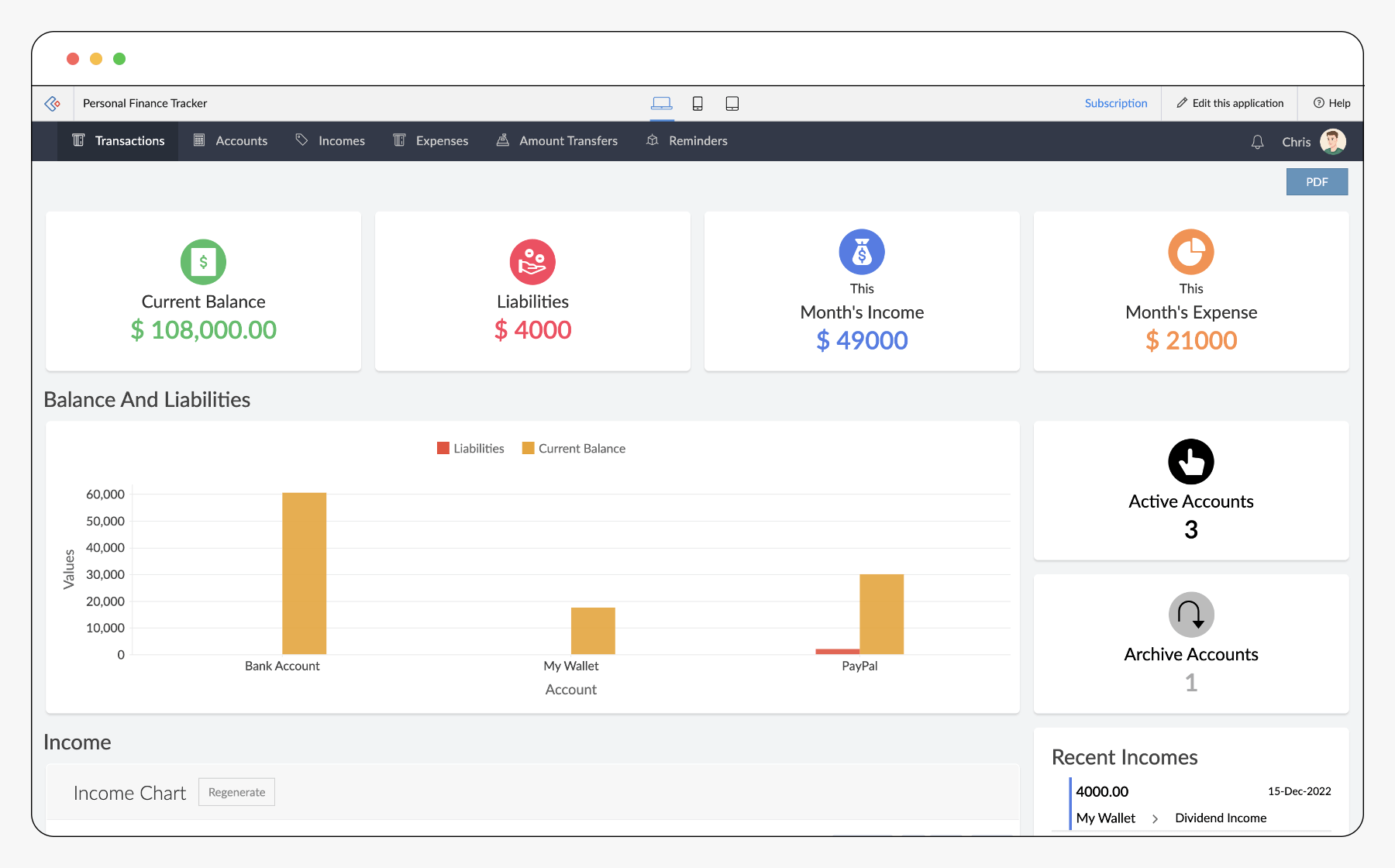

2. Ease of Use

A good finance tool should be intuitive and easy to navigate. You shouldn’t need to spend hours learning how to use it.

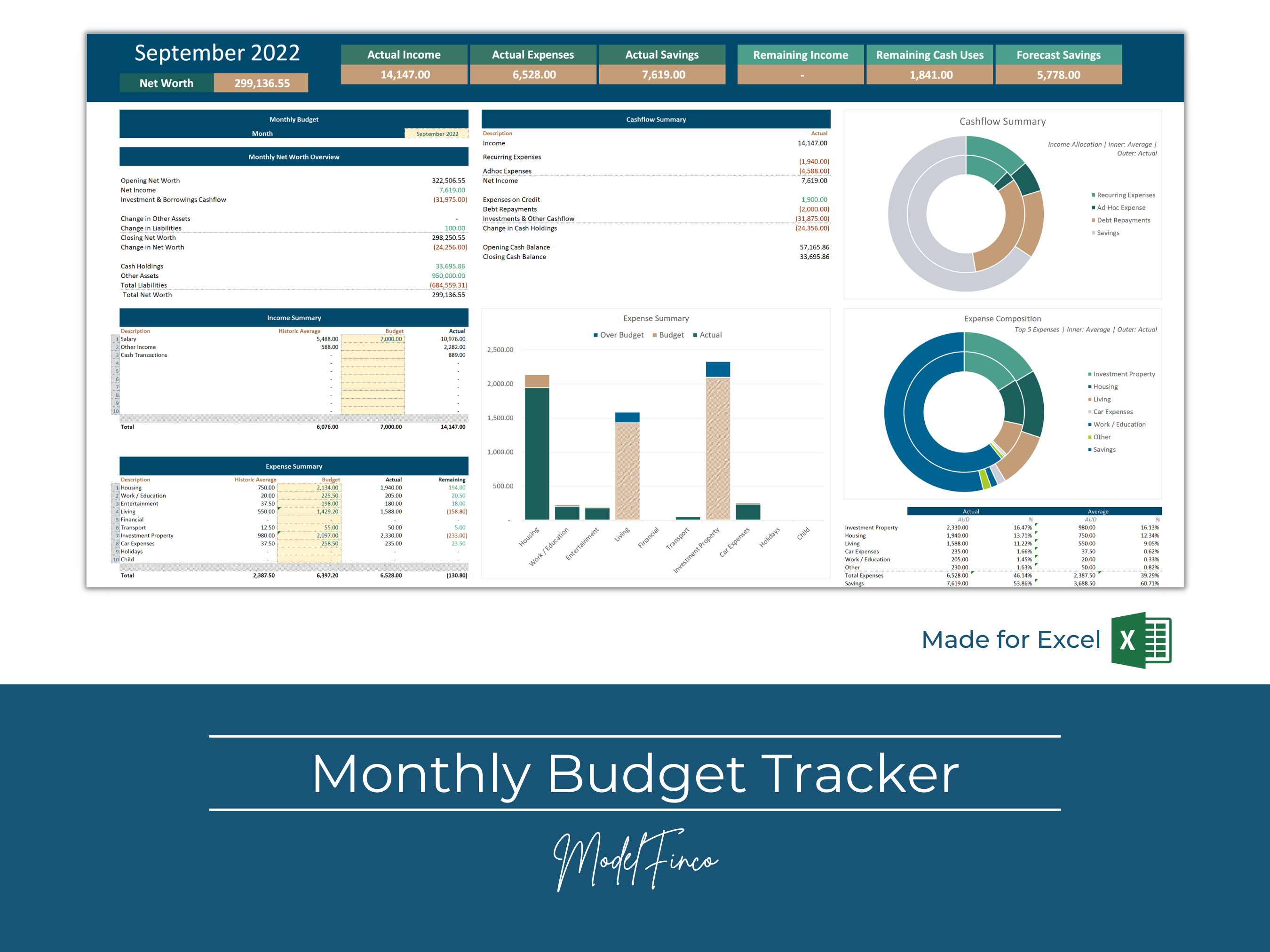

3. Expense Tracking and Budgeting

A great personal finance tool will automatically track your expenses and help you stay within your budget. Look for tools that categorize your spending for you.

4. Goal Setting and Reporting

The best tools will help you set financial goals, track your progress, and generate reports to evaluate how well you’re doing.

5. Integration with Other Tools

Look for tools that integrate with your bank, credit cards, and investment accounts for seamless tracking of all your finances.

Benefits of Using Personal Finance Tools

Using the right tools can significantly improve your financial health. Here are some of the key benefits:

-

Organization: Personal finance tools keep all your financial data in one place, making it easier to manage and track.

-

Time-Saving: These tools automate many tasks like tracking expenses and creating reports, saving you time.

-

Better Decision-Making: With detailed insights into your finances, you can make better, more informed decisions about spending, saving, and investing.

Frequently Asked Questions (FAQs)

1. Are personal finance tools free?

Many personal finance tools, like Mint and PocketGuard, are free to use. However, some tools, such as YNAB and Personal Capital, offer premium features for a fee.

2. Can personal finance tools help me pay off debt?

Yes, tools like YNAB and PocketGuard can help you manage your debt by tracking payments and ensuring you stay on top of your financial obligations.

3. Are personal finance tools secure?

Most personal finance tools use high-level encryption and multi-factor authentication to protect your financial data. Always ensure the tool you choose is reputable and has security features in place.

4. How do I choose the best personal finance tool?

The best personal finance tool depends on your specific needs. If you need a simple budget tracker, PocketGuard is a great choice. If you’re focused on investments and retirement planning, Personal Capital may be the best fit.

Conclusion

In 2025, there are countless personal finance tools designed to help you better manage your money. Whether you’re looking to improve your budgeting, track expenses, or invest for the future, there’s a tool that can help you achieve your financial goals. By choosing the right tools and staying committed to your financial plan, you can take control of your money and set yourself up for long-term success.