10 Lucrative Passive Income Ideas You Can Start Today

In today’s world, generating passive income has become an increasingly popular goal. It allows individuals to make money with minimal effort after the initial setup. Whether you’re looking for long-term wealth-building strategies or side income streams, the opportunities for earning passive income are vast.

What is Passive Income?

Passive income is money earned with minimal active effort. Unlike a traditional job where you need to trade time for money, passive income lets you earn money even when you’re not actively working. The key is to set up systems, investments, or businesses that generate income on their own after a certain amount of time and effort.

Why You Should Pursue Passive Income

There are several reasons to consider building passive income streams:

-

Financial Freedom: With enough passive income, you can reduce your dependence on active work, creating more time for your personal life.

-

Diversify Your Earnings: Having multiple sources of income reduces the risk of relying solely on a job.

-

Wealth Building: Over time, passive income can accumulate significantly, helping you build wealth with little effort.

The appeal of financial freedom and the ability to make money while sleeping has made passive income an attractive goal for many.

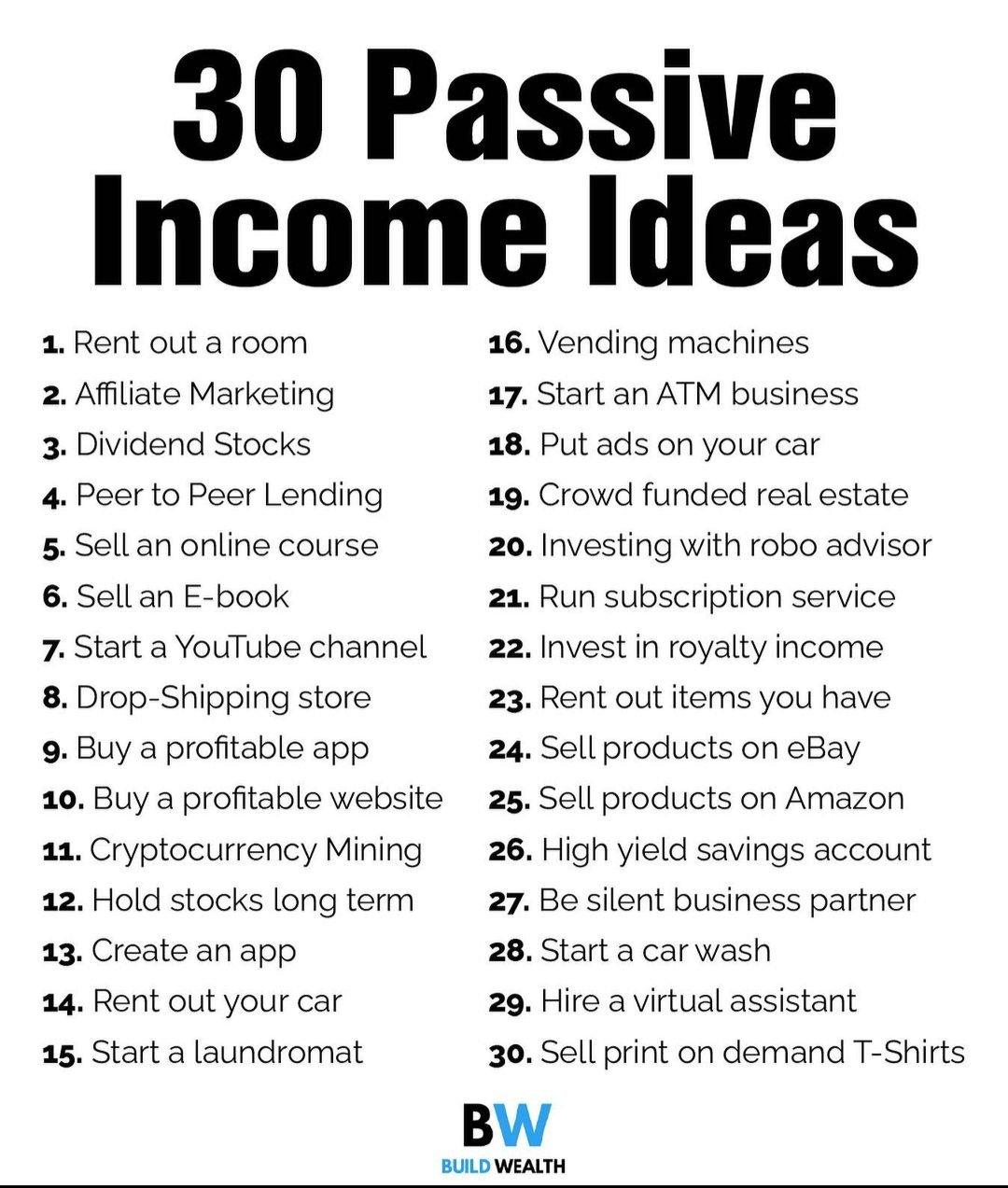

Top 10 Passive Income Ideas for 2025

1. Investing in Dividend Stocks

One of the most popular and straightforward ways to earn passive income is by investing in dividend stocks. These are shares of companies that pay out regular dividends to shareholders. By building a portfolio of dividend-paying stocks, you can create a reliable income stream.

Why Choose Dividend Stocks?

-

Regular Payouts: Receive quarterly or annual dividends based on the performance of the company.

-

Growth Potential: Some dividend stocks also have the potential to appreciate in value over time.

-

Low Effort: Once you’ve invested, your income comes in automatically without needing constant attention.

For more information on investing in dividend stocks, check out this guide on how to get started.

2. Real Estate Investment

Real estate offers a wide variety of opportunities to generate passive income. From rental properties to real estate investment trusts (REITs), there are several ways to invest. Rental properties, in particular, can provide a steady stream of income through monthly rent payments.

Why Choose Real Estate?

-

Tangible Asset: Real estate is a physical asset that can appreciate in value.

-

Regular Cash Flow: Rental properties generate consistent cash flow, especially if you own multiple units.

-

Tax Benefits: You can enjoy various tax advantages when you invest in real estate.

If you’re interested in starting, consider reading this article on real estate investment strategies.

3. Create an Online Course

Are you an expert in a particular subject? Creating an online course can be a great way to turn your knowledge into a stream of passive income. Platforms like Udemy, Teachable, or Skillshare allow you to create, sell, and manage your courses with ease.

Why Choose Online Courses?

-

Scalable: Once created, courses can be sold repeatedly without additional effort.

-

High Earning Potential: Experts in niche topics can command high prices for courses.

-

Global Reach: You can reach a global audience, allowing you to scale your earnings.

For tips on how to create your first online course, visit this step-by-step guide.

4. Affiliate Marketing

Affiliate marketing involves promoting other people’s products and earning a commission when someone makes a purchase through your referral link. You can create a blog, YouTube channel, or even social media pages to market products you believe in.

Why Choose Affiliate Marketing?

-

Low Startup Costs: You don’t need to create a product; you just need to market someone else’s.

-

Flexible: You can work from anywhere and choose products that align with your interests.

-

Passive: Once your affiliate links are in place, they continue to earn you money while you sleep.

If you’re new to affiliate marketing, here’s a beginner’s guide to getting started.

5. Start a Blog or YouTube Channel

A blog or YouTube channel can be an excellent source of passive income if you’re passionate about creating content. By monetizing through ads, sponsorships, and affiliate links, you can earn money over time as your audience grows.

Why Choose Blogging or YouTube?

-

Creative Freedom: Choose the topics you’re most passionate about.

-

Scalable: The more content you create, the more opportunities for passive income.

-

Global Audience: You can reach people worldwide through search engines or social platforms.

For tips on starting your blog or YouTube channel, here’s a guide to creating a successful blog.

6. Invest in Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms like LendingClub or Prosper allow you to lend money to individuals or small businesses in exchange for interest. This form of alternative investment can generate regular income if you lend to borrowers who repay their loans.

Why Choose Peer-to-Peer Lending?

-

Higher Interest Rates: You can earn higher returns compared to traditional savings accounts.

-

Diversification: P2P lending adds a different asset class to your portfolio.

-

Flexibility: You can choose the loan terms and risk level that fit your preferences.

To learn more about P2P lending, check out this beginner’s guide to peer-to-peer lending.

7. Write an E-book

If you have a passion for writing, writing an e-book is an excellent way to generate passive income. With platforms like Amazon Kindle Direct Publishing (KDP), you can easily publish and sell your e-books to a global audience.

Why Choose E-books?

-

Low Startup Costs: All you need is your knowledge and a writing platform to publish your e-book.

-

Global Reach: Once published, your e-book can be sold worldwide.

-

Royalties: You earn royalties on each sale, creating a continuous income stream.

For a detailed guide on how to write and publish your e-book, check out this resource on Amazon KDP.

8. Develop an App or Software

Creating an app or software that solves a common problem can be a lucrative way to earn passive income. Once developed and launched, your app can generate revenue through in-app purchases, subscriptions, or advertisements.

Why Choose App Development?

-

Scalable: A successful app can be used by thousands or even millions of users.

-

Global Reach: Apps can be downloaded worldwide, providing access to a vast market.

-

Ongoing Revenue: Once built, your app can earn revenue passively through app stores.

To get started, visit this guide on developing apps for passive income.

9. Create a Mobile App

Mobile apps have become a part of everyday life, and creating one can provide a consistent stream of income. With monetization strategies such as in-app purchases, ads, or subscriptions, mobile apps can generate passive income over time.

Why Choose Mobile Apps?

-

High Earning Potential: If your app goes viral, the earning potential can be massive.

-

Recurring Revenue: Subscriptions and in-app purchases offer ongoing earnings.

-

Creative Freedom: You have the flexibility to create an app in any niche that interests you.

For inspiration, here’s a list of some of the best mobile apps for passive income.

10. Rent Out Your Car or Equipment

If you own a car, boat, or any other valuable equipment, you can rent them out to others. Platforms like Turo for car rentals or Fat Llama for equipment allow you to make passive income from items you already own.

Why Choose Renting Out Your Assets?

-

No Extra Effort: Once listed, your assets can generate income without ongoing effort.

-

Monetize Idle Assets: Rent out items you aren’t using to create additional income.

-

Flexible: You can rent out your items whenever you want.

For more on how to rent out your car, check out this guide on Turo.

Conclusion

Building passive income streams is an excellent way to achieve financial freedom and supplement your income. From investing in dividend stocks to creating online courses, there are many options available for those looking to earn money without the constant grind. By exploring and leveraging these ideas, you can start building a more secure financial future today.

Now is the perfect time to start!