Money App Security: Protecting Your Finances in the Digital Age

As more people rely on money apps for everyday financial transactions, the importance of money app security cannot be overstated. From online banking to peer-to-peer payments, these apps offer unparalleled convenience but also expose users to potential security risks. This article will explore the best practices for keeping your money apps secure, the common threats to look out for, and tips on choosing the most secure apps.

1. Why Money App Security Matters

Money apps, such as Venmo, PayPal, and Cash App, have become essential for transferring funds, paying bills, and managing finances on the go. However, the digital nature of these platforms makes them susceptible to hacking and fraud. Protecting your personal and financial information from malicious actors should be a top priority.

The Risk of Fraud

Money apps store sensitive information like your bank account details, credit card numbers, and transaction history. If these apps are not properly secured, hackers can gain access to your funds and make unauthorized transactions. This is why it’s crucial to take steps to protect your accounts and ensure you’re using a secure platform.

The Growing Threat of Cybercrime

Cybercrime is on the rise, and money apps are prime targets for scammers. Phishing attacks, data breaches, and identity theft are common threats that could put your personal finances at risk. By understanding how to secure your apps and recognizing potential risks, you can minimize your exposure.

2. Top Money App Security Features to Look For

When choosing a money app, it’s essential to consider its security features. Here are some key aspects to look for to ensure your financial data is protected:

1. Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of protection to your account. This feature requires you to provide two forms of identification (usually a password and a code sent to your phone) before gaining access to your account. Enabling 2FA significantly reduces the risk of unauthorized access.

2. End-to-End Encryption

End-to-end encryption ensures that your data is encrypted when it’s sent over the internet, making it unreadable to hackers. Look for money apps that use encryption to protect your personal and financial information.

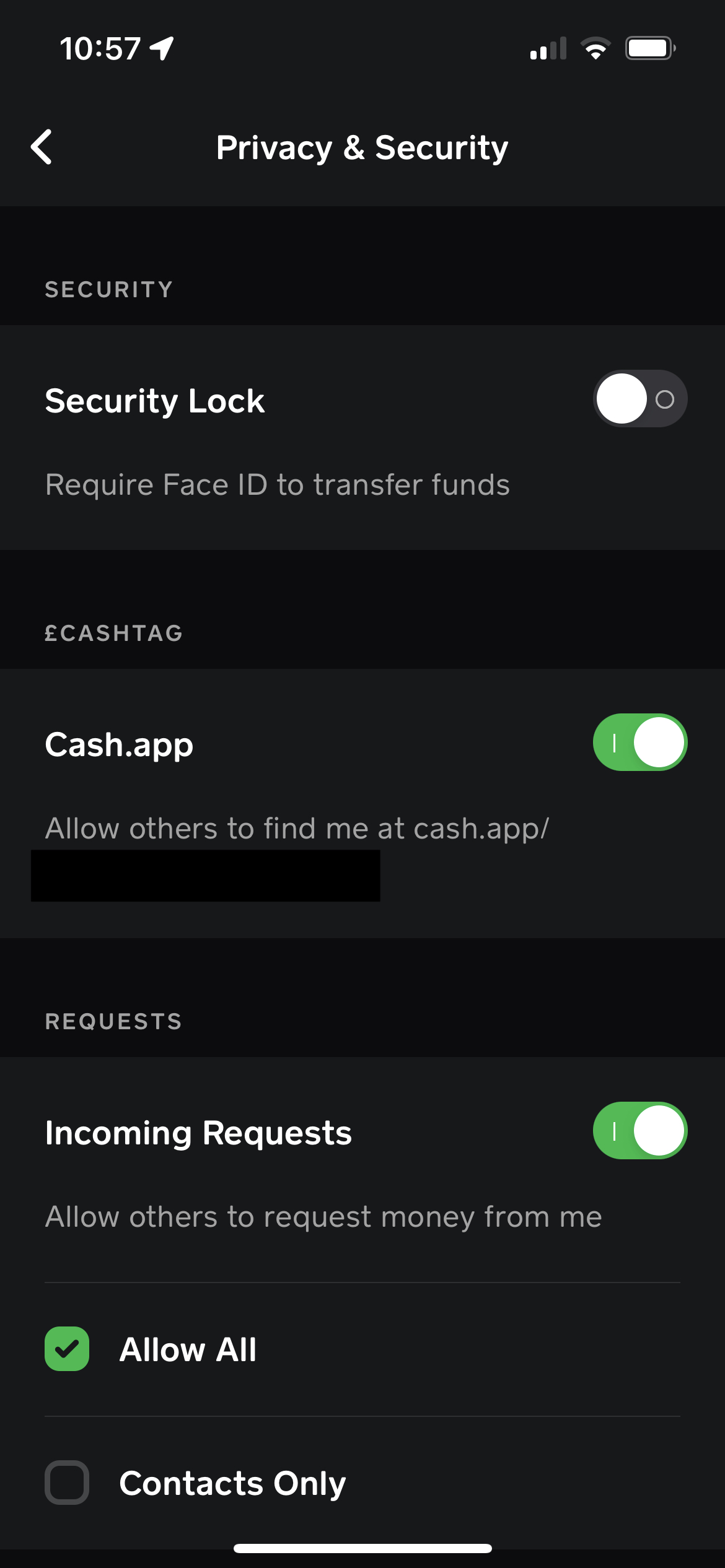

3. Biometric Authentication

Biometric security features, such as fingerprint or face recognition, offer a convenient and secure way to log into your account. These features are harder for hackers to bypass compared to traditional passwords.

4. Account Activity Alerts

Most secure money apps send you alerts whenever there’s unusual activity, such as a large transaction or login from an unknown device. These alerts help you detect fraud early, giving you time to take action if necessary.

3. Common Security Risks with Money Apps

While money apps provide many benefits, they also come with inherent security risks. Understanding these risks can help you protect your account from potential threats:

1. Phishing Scams

Phishing involves fraudulent attempts to obtain sensitive information by impersonating legitimate organizations or apps. Scammers may send fake emails or text messages claiming to be from your money app, prompting you to click on malicious links and enter your login credentials. Always verify any communication you receive before clicking links or providing personal information.

2. Account Takeover

An account takeover occurs when a hacker gains access to your money app account, often by stealing your login credentials. This can happen if your password is weak or if you reuse passwords across multiple platforms. Protect your account by using strong, unique passwords and enabling two-factor authentication.

3. Data Breaches

Money apps may be vulnerable to data breaches, where hackers access sensitive user data stored by the app. While many reputable money apps take extensive measures to protect user data, no system is completely immune. Always update your app to the latest version to ensure you have the latest security patches.

4. Public Wi-Fi Risks

Using money apps on public Wi-Fi networks can expose your data to hackers. Public networks are not secure, and cybercriminals can intercept your data. If you need to use a money app on a public Wi-Fi network, consider using a VPN to encrypt your connection.

4. How to Protect Your Money App Accounts

Taking proactive steps to secure your accounts is essential for preventing fraud. Here are some tips to ensure your money app accounts stay safe:

1. Use Strong, Unique Passwords

A strong password should contain a mix of uppercase and lowercase letters, numbers, and special characters. Avoid using easily guessable information like your name, birthdate, or common words. Consider using a password manager to generate and store complex passwords securely.

2. Enable Two-Factor Authentication

As mentioned earlier, enabling two-factor authentication (2FA) adds an extra layer of security. Even if someone manages to obtain your password, they won’t be able to access your account without the second factor.

3. Monitor Your Accounts Regularly

Regularly checking your account activity can help you spot any suspicious transactions. Set up alerts for activities such as login attempts or money transfers. If you notice anything unusual, report it to the app’s support team immediately.

4. Keep Your App Updated

App developers regularly release updates that fix security vulnerabilities. Make sure you keep your money app updated to the latest version to ensure it’s protected against known threats.

5. Use Secure Networks

Always avoid using unsecured Wi-Fi networks when accessing your money apps. Public Wi-Fi networks can expose your data to hackers. If you must use a public network, consider using a VPN to protect your connection.

5. Choosing the Most Secure Money Apps

When selecting a money app, security should be a top priority. Some apps offer better protection than others, and it’s essential to choose a platform that prioritizes the safety of your data.

1. Look for Trusted Apps

Choose apps from well-known, reputable companies that have a proven track record of security. Popular apps like PayPal, Venmo, and Cash App are generally safe, but always do your research before trusting an app with your financial information.

2. Check for Certifications and Reviews

Look for apps that are certified by financial regulatory bodies and have positive reviews from users. Independent security audits and certifications indicate that an app meets industry standards for protecting user data.

3. Read the Privacy Policy

Before using a money app, read its privacy policy to understand how your data is protected and used. A trustworthy app will clearly outline its security practices, including how it stores and encrypts your data.

6. Frequently Asked Questions (FAQs)

1. How do I know if my money app is secure?

Check for features like two-factor authentication, end-to-end encryption, and biometric authentication. A secure app will also have clear privacy policies and offer account activity alerts.

2. What should I do if I suspect my account has been compromised?

If you suspect unauthorized access to your account, immediately change your password, enable two-factor authentication, and report the issue to customer support. Monitor your account for any suspicious activity.

3. Are money apps safer than using a credit card or cash?

While money apps offer convenience, they come with security risks. However, apps with strong security features, such as encryption and 2FA, can be safer than carrying cash or using credit cards, especially when combined with safe browsing habits.

4. Can I use a money app on public Wi-Fi?

It’s not recommended to use money apps on public Wi-Fi due to the risk of data interception. If you must, use a VPN to encrypt your connection and reduce the risk.

5. Are my funds insured with money apps?

Some money apps, like PayPal and Venmo, offer limited protections against fraud, but your funds may not be insured in the same way as funds in a traditional bank account. Check the app’s policies to understand the level of protection offered.

Conclusion

Ensuring the security of your money app accounts is essential to protect your financial well-being in the digital world. By following best practices such as using strong passwords, enabling two-factor authentication, and choosing reputable apps, you can safeguard your information against cyber threats. Stay vigilant and monitor your accounts regularly to minimize the risk of fraud and theft.

By understanding the risks and taking proactive measures, you can use money apps with confidence, knowing that your financial data is well-protected.