Loan Comparison Sites: Finding the Best Deals for Your Financial Needs

In today’s financial world, loan comparison sites have become an invaluable tool for borrowers looking to secure the best possible rates and terms. Whether you’re looking for a mortgage, personal loan, or auto loan, comparing offers from different lenders can save you time and money. This guide will explore how loan comparison sites work, why you should use them, and how to make the most of these platforms to find the perfect loan for your needs.

1. What Are Loan Comparison Sites?

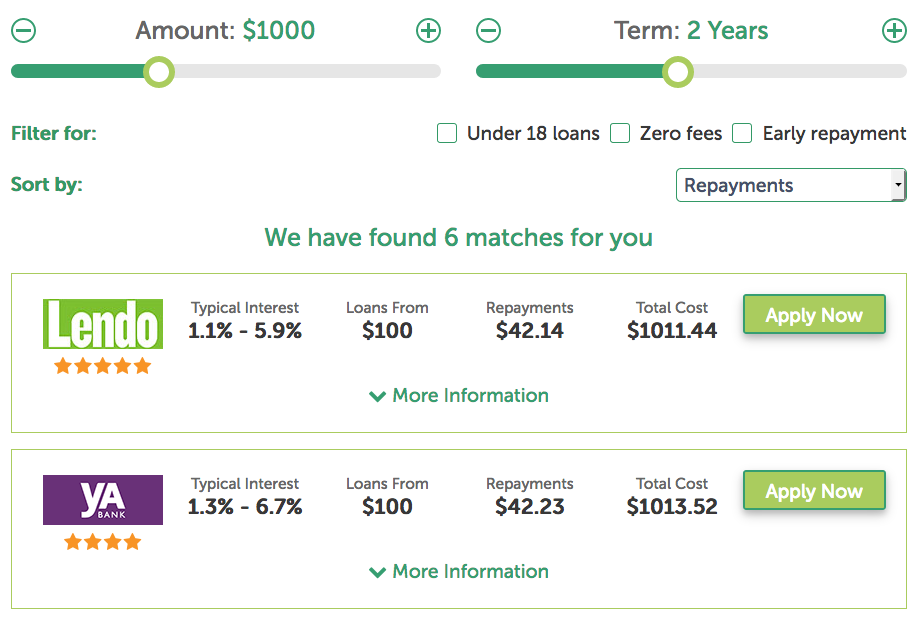

A loan comparison site is an online platform that allows you to compare different loan offers from multiple lenders. By entering your financial information and the type of loan you’re looking for, these sites generate a list of loan options, showing key details like interest rates, fees, loan terms, and monthly payments.

These platforms simplify the process of shopping for a loan, giving you the ability to compare terms and conditions in one place. Instead of visiting individual lender websites, loan comparison sites gather and present data from several lenders, allowing you to make an informed decision in less time.

How Loan Comparison Sites Work:

-

Search Criteria: You provide information about your financial situation (such as your credit score, loan amount, and loan type).

-

Matching Lenders: The site then matches you with lenders who are most likely to offer loans that fit your profile.

-

Compare Offers: You can view various loan offers, helping you compare rates, fees, and other important details side by side.

Using these sites is simple, and it allows you to find the best loan terms for your specific financial situation.

2. Benefits of Using Loan Comparison Sites

Using a loan comparison site offers several key benefits that can help you secure the best possible loan deal. Here are some of the top reasons why you should use these platforms:

1. Saves Time and Effort

Instead of manually visiting multiple lender websites, loan comparison sites allow you to compare various offers quickly. You can see all the loan options in one place, making it much easier to evaluate them.

2. Better Loan Terms

By comparing loan offers, you can identify the best rates and terms available to you. This can result in lower monthly payments, less interest paid over the life of the loan, and fewer fees.

3. Increased Transparency

Loan comparison sites provide clear, side-by-side comparisons of rates and fees. This transparency helps you understand exactly what you’re getting into before committing to a loan, reducing the likelihood of hidden costs.

4. Access to Multiple Lenders

Loan comparison sites give you access to a variety of lenders, including banks, credit unions, and online lenders. This increases your chances of finding a loan that meets your needs, even if you have unique requirements or a less-than-perfect credit score.

3. Popular Loan Comparison Sites to Consider

Several loan comparison websites are known for providing reliable, up-to-date loan options. Here are a few popular sites to consider when looking for your next loan:

-

NerdWallet: NerdWallet allows you to compare a wide range of loan products, including personal loans, mortgages, auto loans, and student loans. The platform is user-friendly and provides detailed information about each loan type.

-

LendingTree: LendingTree offers personalized loan offers for everything from mortgages to personal loans. Their easy-to-use platform lets you compare loans from a variety of lenders quickly.

-

Bankrate: Bankrate’s comparison tool gives you access to multiple types of loans, including home loans, auto loans, and personal loans, with detailed information about rates and terms.

-

Compare the Market: This UK-based platform allows users to compare personal loans, credit cards, and mortgages, helping borrowers find the best loan offers available.

-

CashCompare: A site dedicated to comparing loans, CashCompare offers an easy way to compare rates and loan options to suit your financial needs.

4. How to Use Loan Comparison Sites Effectively

While loan comparison sites can provide valuable information, it’s important to use them effectively to get the most out of your comparison.

Step 1: Know Your Loan Requirements

Before you begin comparing loans, be clear about the type of loan you need. Whether you’re looking for a personal loan, mortgage, or auto loan, knowing your requirements helps filter out irrelevant options.

Step 2: Input Accurate Information

Loan comparison sites ask for your credit score, income, loan amount, and loan term. Ensure that you enter accurate information so that the platform can provide you with the most relevant loan options.

Step 3: Compare Multiple Offers

Don’t settle for the first loan offer you see. Take the time to compare various options, even if it takes a bit longer. Look at the interest rate, fees, loan term, and repayment schedule before making a decision.

Step 4: Read the Fine Print

Always read the terms and conditions carefully before agreeing to a loan. Watch out for hidden fees or clauses that could affect your repayment schedule.

Step 5: Consider Your Financial Situation

Be realistic about what you can afford. Even though a loan may offer low monthly payments, ensure that it fits into your budget without stretching your finances too thin.

5. Common Loan Types to Compare

Loan comparison sites offer several types of loans. Here are some of the most common types you’ll encounter:

1. Personal Loans

Personal loans are unsecured loans that can be used for various purposes, such as debt consolidation, home improvements, or medical expenses. These loans generally have higher interest rates than secured loans but can be ideal if you don’t want to put up collateral.

2. Mortgages

Mortgage comparison sites allow you to compare fixed-rate and adjustable-rate mortgages. Compare different loan terms, down payment requirements, and interest rates to find the most affordable mortgage.

3. Auto Loans

If you’re in the market for a new or used car, loan comparison sites can help you find the best auto loan with the lowest interest rates and favorable terms.

4. Student Loans

Whether you need federal or private loans for college, comparison sites can help you find student loan offers with competitive interest rates and repayment options.

5. Business Loans

If you’re a small business owner, comparison sites can also help you compare small business loans, including SBA loans, lines of credit, and equipment financing.

6. Loan Comparison Sites: Fees and Costs to Consider

While using loan comparison sites can save you money, it’s important to consider the potential costs associated with using these platforms.

1. Registration Fees

Some loan comparison sites may charge a fee for accessing certain features, such as premium loan offers or detailed loan reports. Always check for any registration or service fees before signing up.

2. Loan Origination Fees

Some lenders may charge a fee to process your loan application, known as the loan origination fee. Compare these fees across multiple lenders to find the most cost-effective loan.

3. Prepayment Penalties

Check for any prepayment penalties that could charge you a fee if you pay off the loan early. Not all lenders impose this penalty, so be sure to compare the fine print.

7. Frequently Asked Questions (FAQs)

1. What is the best loan comparison site?

The best loan comparison site depends on your needs. NerdWallet, LendingTree, and Bankrate are some of the most reputable platforms for comparing loans.

2. Can loan comparison sites affect my credit score?

Most loan comparison sites perform a soft inquiry, meaning they won’t affect your credit score. However, some lenders may perform a hard inquiry when you apply for a loan, which could impact your score.

3. How do loan comparison sites make money?

Loan comparison sites usually make money through affiliate marketing, earning a commission when you click on a lender’s offer or sign up for a loan.

4. Are loan comparison sites trustworthy?

Yes, most loan comparison sites are trustworthy and provide accurate, updated information. However, always read reviews and check for site credentials to ensure reliability.

5. Can I compare loans for bad credit?

Yes, many loan comparison sites cater specifically to individuals with bad credit. They allow you to compare offers from lenders that specialize in subprime loans.

Conclusion

Loan comparison sites are a valuable tool for anyone looking to secure the best possible loan terms. By using these platforms, you can easily compare multiple offers, understand the terms and conditions, and make a more informed decision. Whether you’re applying for a mortgage, personal loan, or auto loan, taking the time to shop around can save you money and ensure you get the best deal possible.

Remember to always read the fine print, compare several options, and choose the loan that fits your financial situation.