Investment App Ratings: Choosing the Best Platform for Your Financial Future

In today’s world, investing is no longer just for the wealthy or financial experts. With the rise of investment apps, anyone with a smartphone can start investing in stocks, bonds, cryptocurrencies, and more. However, with so many options available, how do you choose the best one? This guide reviews the top-rated investment apps of 2025 to help you make an informed decision on which platform suits your needs.

Why Use Investment Apps?

Investment apps have revolutionized the way people approach investing. These platforms offer a range of features that cater to both novice investors and seasoned traders. From simplified interfaces to sophisticated trading tools, these apps help individuals manage their portfolios, access market information, and execute trades without stepping into a traditional brokerage.

Key Benefits of Investment Apps:

-

User-Friendly Interfaces: Most apps are designed to be intuitive and easy to navigate, even for beginners.

-

Low Fees: Many investment apps offer low or no-fee trading, making investing more accessible.

-

Real-Time Updates: Get access to live market data and manage your portfolio from anywhere.

-

Educational Resources: Many apps provide articles, videos, and tutorials to help you learn about investing.

Top Investment Apps to Consider in 2025

Let’s take a closer look at the best-rated investment apps available today. Each platform offers unique features that appeal to different types of investors.

1. Robinhood: Free Stock Trading with Simple Features

Robinhood is a household name when it comes to commission-free trading. Known for pioneering zero-fee trading, it remains one of the best apps for new investors who want to trade stocks, options, and ETFs without paying hefty commissions.

Features of Robinhood:

-

Commission-Free Trading: Trade stocks, ETFs, options, and cryptocurrencies with no commission fees.

-

Fractional Shares: Invest in a portion of expensive stocks with fractional shares.

-

Real-Time Market Data: Stay updated with live market data and news.

-

Cash Management: Robinhood offers a cash management feature that lets you earn interest on your uninvested cash.

While Robinhood’s simplicity is appealing, its limited research tools may not be ideal for advanced traders. Learn more about Robinhood.

2. E*TRADE: Robust Features for Active Investors

ETRADE offers a more comprehensive platform for active traders who need a variety of tools and features to make informed decisions. Known for its detailed research tools, real-time streaming quotes, and powerful charting options, ETRADE appeals to those who want more control over their investment decisions.

Features of E*TRADE:

-

Comprehensive Research Tools: Access in-depth reports, stock analysis, and market insights.

-

Advanced Trading Tools: Utilize charting, technical indicators, and other professional tools.

-

Variety of Investments: Trade stocks, options, mutual funds, and ETFs.

-

Mobile App: E*TRADE’s mobile app provides all the features of its desktop platform for trading on the go.

E*TRADE is ideal for investors who want a more hands-on approach and are looking for a comprehensive suite of tools. Check out E*TRADE.

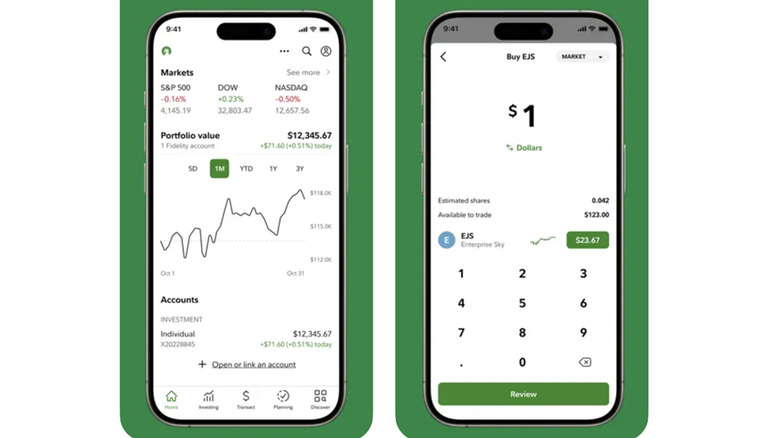

3. Fidelity: Low-Cost Trading and Wealth Management Services

Fidelity is one of the leading names in the investment world, offering a wide range of investment products, from stocks to retirement accounts. Known for its low-cost trading and wealth management services, Fidelity is a great choice for both beginners and seasoned investors.

Features of Fidelity:

-

No Commission Fees: Fidelity offers commission-free trading on stocks and ETFs.

-

Robo-Advisory Services: Get automated investment advice for your portfolio through Fidelity Go.

-

Retirement Planning: Fidelity’s platform provides access to IRAs and other retirement planning tools.

-

Research Tools: Use Fidelity’s robust research tools to evaluate investment opportunities.

Whether you’re saving for retirement or looking to build a diversified portfolio, Fidelity provides a well-rounded platform for a wide range of investors. Learn more about Fidelity.

4. Acorns: Micro-Investing for Beginners

Acorns takes a unique approach to investing by helping users build wealth through micro-investing. The app rounds up your everyday purchases to the nearest dollar and invests the change into a diversified portfolio.

Features of Acorns:

-

Round-Ups: Automatically invest spare change from your everyday purchases.

-

Pre-Built Portfolios: Choose from several diversified portfolios based on your risk tolerance.

-

Retirement Accounts: Acorns offers both individual investment accounts and IRAs for retirement savings.

-

Automatic Contributions: Set up automatic transfers to grow your investment over time.

Acorns is an excellent choice for beginners who want to start investing without having to commit large amounts of money upfront. Explore Acorns.

5. Wealthfront: Automated Investment and Financial Planning

Wealthfront is a robo-advisor that automates your investments by using algorithms to create a diversified portfolio based on your goals. It’s an ideal choice for hands-off investors who want a smart and efficient way to grow their wealth.

Features of Wealthfront:

-

Automated Portfolio Management: Wealthfront builds and manages your portfolio based on your financial goals.

-

Tax-Loss Harvesting: The app helps minimize taxes by automatically selling losing investments to offset gains.

-

Financial Planning Tools: Wealthfront provides tools to plan for long-term goals, including retirement and college savings.

-

Low Fees: Wealthfront offers low management fees, making it cost-effective for investors.

If you prefer a hands-off investment strategy, Wealthfront’s automated approach can help you stay on track with minimal effort. Check out Wealthfront.

How to Choose the Best Investment App

With so many investment apps available, choosing the right one depends on your personal investment goals and experience level. Here are some factors to consider when making your decision:

1. Fees and Costs

Some apps charge commission fees on trades, while others are completely free. Be sure to choose a platform that fits your budget and investment strategy. Low fees can make a significant difference in the long term, especially for smaller investors.

2. Types of Investments

Consider the types of investments you want to make. Some apps focus on stocks and ETFs, while others provide access to a broader range of assets, including cryptocurrencies or real estate investments. Choose an app that aligns with your investment interests.

3. User Interface

If you’re new to investing, look for an app with an easy-to-use interface. Simplicity is key for beginners, but advanced features may be necessary for more experienced traders.

4. Customer Support

Having access to reliable customer support can be a lifesaver when you encounter issues with your investments. Check whether the app offers phone or live chat support and if they have a helpful FAQ section.

Frequently Asked Questions (FAQs)

1. Are Investment Apps Safe to Use?

Yes, most investment apps use industry-standard encryption to protect your data. However, it’s essential to choose an app that is regulated by financial authorities for added security.

2. Can I Trade Cryptocurrencies Using These Apps?

Yes, many investment apps, including Robinhood and Fidelity, allow users to trade cryptocurrencies alongside traditional assets like stocks and ETFs.

3. How Much Money Do I Need to Start Investing?

Many investment apps have low minimum requirements. Some, like Acorns, allow you to start with just a few dollars, while others, like E*TRADE, may require a larger initial deposit.

Conclusion

Choosing the right investment app is crucial to achieving your financial goals. Whether you’re looking for low fees, advanced trading tools, or automated investment management, there is an app tailored to your needs. Robinhood, E*TRADE, Fidelity, Acorns, and Wealthfront all offer unique features that cater to different investment strategies and experience levels.

Start your investment journey today by exploring these top-rated apps and take control of your financial future!

Invest wisely, and your future self will thank you!