Financial Wellness Tips: Achieve Financial Health and Security

Financial wellness is an essential aspect of overall well-being. It goes beyond simply having money; it involves managing your finances in a way that reduces stress, allows for future security, and helps you live a comfortable life. Whether you’re just starting out or are looking to improve your financial habits, these financial wellness tips will guide you toward a healthier financial future.

What is Financial Wellness?

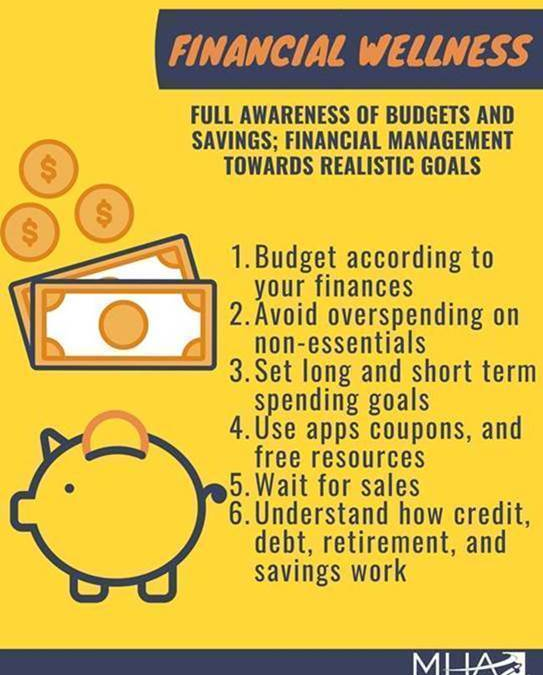

Financial wellness refers to the state of being financially healthy. It means having control over your finances, making informed decisions, and having a clear understanding of how your money affects your overall well-being. Financial wellness is achieved by balancing income, savings, investments, and spending to maintain a secure and stress-free life.

Why is Financial Wellness Important?

Maintaining good financial health is crucial for a number of reasons. First, it provides peace of mind. When you’re financially healthy, you’re less likely to experience anxiety or stress about money. Second, it ensures you have enough resources for life’s milestones, like buying a house, retirement, or managing unexpected expenses. Lastly, financial wellness allows you to make choices that align with your values, not just your paycheck.

Financial Wellness Tips to Improve Your Financial Health

Achieving financial wellness doesn’t happen overnight, but with a few smart decisions and consistent habits, it’s entirely within reach. Here are some financial wellness tips that can help you get started:

1. Create a Budget and Stick to It

A budget is the foundation of good financial health. It helps you track your income and expenses, ensuring you don’t spend more than you earn. Start by categorizing your expenses into needs (such as housing and groceries) and wants (like entertainment and dining out).

Here are a few tips for effective budgeting:

-

Track your spending: Keep a record of every expense to identify areas where you can cut back.

-

Use budgeting tools: Apps like Mint or YNAB (You Need A Budget) can help streamline this process.

Pro Tip: Regularly reviewing your budget will help you adjust it to changing circumstances, ensuring you stay on top of your finances.

2. Build an Emergency Fund

Life is unpredictable, and having an emergency fund ensures that you’re prepared for unexpected situations, such as medical emergencies or job loss. Aim to save 3-6 months’ worth of living expenses in an easily accessible account.

Tips for building an emergency fund:

-

Set a goal: Determine how much you need and start small.

-

Automate savings: Set up automatic transfers from your checking account to a savings account to make saving effortless.

An emergency fund provides a safety net, preventing you from relying on credit cards or loans when life throws curveballs.

3. Reduce Debt and Manage Credit Wisely

Managing debt is a crucial aspect of financial wellness. High levels of debt can significantly impact your financial health and limit your ability to save.

Here’s how to manage debt effectively:

-

Pay off high-interest debt first: Focus on credit cards and payday loans before tackling other debts.

-

Consolidate debt: Consider consolidating multiple loans into one to lower your interest rates.

-

Maintain good credit: Pay bills on time, keep credit card balances low, and monitor your credit report regularly.

Effective debt management is crucial for long-term financial security and health.

4. Start Saving and Investing Early

Saving and investing are key to building wealth over time. The earlier you start, the more time your money has to grow, thanks to compound interest. Here’s how to start:

-

Start with retirement savings: Contribute to retirement accounts like 401(k) or IRA.

-

Invest in low-cost index funds: For long-term growth, consider investing in diversified portfolios with minimal fees.

Even small contributions can grow significantly over time. The key is to get started as soon as possible.

5. Plan for the Future with Financial Goals

Having clear financial goals is a critical part of achieving financial wellness. Goals give you direction and help you stay motivated. Whether you’re saving for retirement, a new home, or a vacation, setting realistic goals is the first step toward achieving them.

Here are a few goal-setting tips:

-

Break down big goals into smaller steps: This makes it easier to achieve and maintain motivation.

-

Review your goals regularly: Track your progress and make adjustments as needed.

Financial goals give your money purpose and help you prioritize your spending.

6. Monitor Your Credit Regularly

Your credit score plays a major role in your financial wellness. A good credit score can help you secure loans with better interest rates, while a poor credit score may result in higher costs for borrowing.

Tips for maintaining a good credit score:

-

Check your credit report: Review your credit report annually to ensure its accuracy.

-

Keep credit utilization low: Aim to use no more than 30% of your available credit limit.

-

Pay bills on time: Set reminders or automate payments to avoid late fees.

By regularly monitoring your credit, you ensure that you’re in control of your financial health.

Financial Wellness and Mental Health

Financial stress can have a significant impact on mental health. Many people feel overwhelmed by debt or financial instability, which can lead to anxiety, depression, and even relationship issues. By following these financial wellness tips, you can reduce stress and improve your mental health.

It’s important to remember that financial wellness isn’t just about numbers—it’s about your overall quality of life. Managing your finances properly reduces stress, increases your confidence, and helps you feel more secure about your future.

FAQs about Financial Wellness

1. How much should I save for an emergency fund?

Aim to save between 3-6 months’ worth of expenses. This will give you the cushion you need to handle unexpected events.

2. How can I reduce my debt quickly?

Focus on paying off high-interest debts first, such as credit card balances, while making minimum payments on others. Consider consolidating your debt for a lower interest rate.

3. What are the best investment strategies for beginners?

Start with low-cost index funds and retirement accounts, like a 401(k) or IRA. Over time, you can diversify your portfolio as you gain more confidence and knowledge.

4. Why is financial wellness important?

Financial wellness impacts not only your finances but also your mental health and quality of life. When you feel financially secure, you’re less likely to experience anxiety, and you can make better decisions about your future.

5. What are the first steps in achieving financial wellness?

Start by creating a budget, building an emergency fund, and reducing debt. From there, work on saving for future goals and improving your credit score.

Conclusion

Achieving financial wellness is a journey, not a destination. By following these tips and consistently working towards your goals, you can create a stable and stress-free financial future. Start today by focusing on budgeting, saving, and investing—your financial health is worth the effort.