Financial Freedom Ideas: Unlock Your Path to Independence

Achieving financial freedom is a goal many people aspire to, but not everyone knows where to start. With the right strategies and mindset, you can take control of your finances, break free from debt, and secure a future that aligns with your dreams. In this article, we’ll explore actionable financial freedom ideas that will help you achieve your financial goals.

1. What Is Financial Freedom?

Financial freedom refers to the state of having enough income and assets to cover your living expenses without relying on active employment or a traditional job. It means you have control over your financial future, and you’re not constantly worried about money. It involves building wealth, managing debt, and investing for the long term.

Why Is Financial Freedom Important?

Financial freedom is more than just about having money; it’s about having options. When you reach financial independence, you can:

-

Choose how you spend your time, whether it’s pursuing passions, spending more time with family, or traveling the world.

-

Eliminate stress related to money worries.

-

Have the flexibility to retire early or shift careers if desired.

2. Financial Freedom Ideas to Get You Started

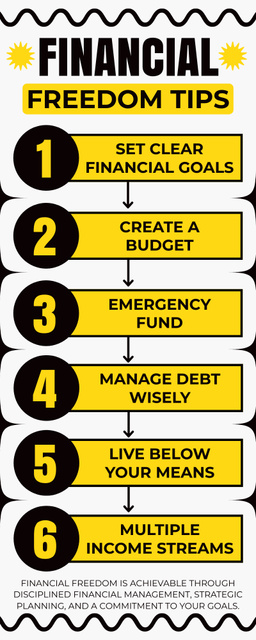

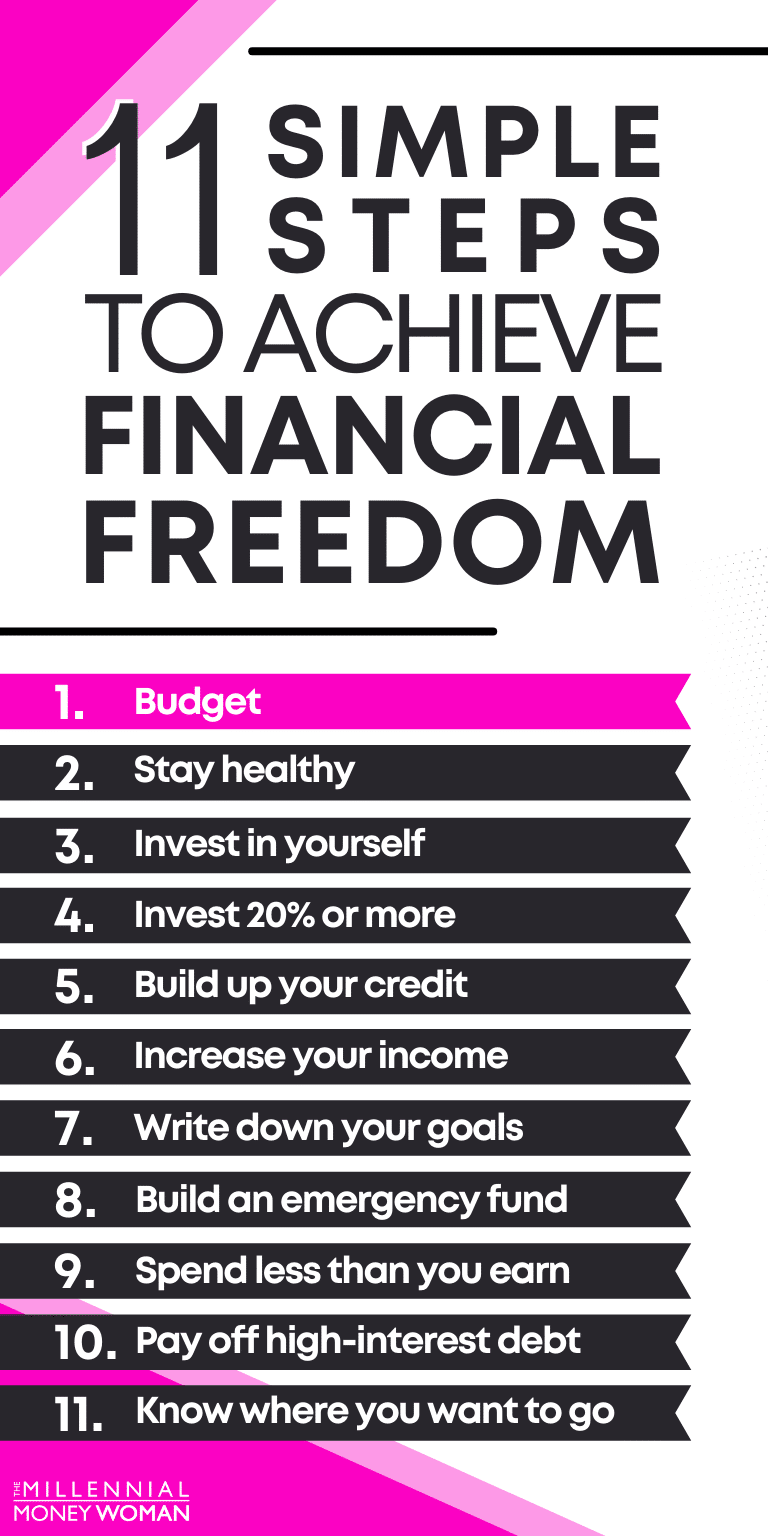

Achieving financial freedom doesn’t happen overnight, but with dedication and smart strategies, it’s possible. Below are some proven financial freedom ideas to help you take charge of your financial future.

1. Create a Detailed Budget

A clear and actionable budget is essential for managing your money. Knowing exactly where your money is going helps you identify areas for improvement and saves you from unnecessary spending.

-

Track your income and expenses to know exactly where you stand financially.

-

Cut back on non-essential spending and prioritize saving and investing.

2. Pay Off High-Interest Debt

Debt is a major obstacle to financial freedom. High-interest debt, such as credit card debt, can quickly spiral out of control. Focus on paying off high-interest debt first.

-

Consider the debt snowball method (paying off smaller debts first) or the debt avalanche method (tackling higher-interest debt first) to accelerate repayment.

-

If possible, consolidate or refinance to lower interest rates.

3. Build an Emergency Fund

An emergency fund acts as a financial safety net in case of unexpected events like medical expenses, car repairs, or job loss. Aim to save at least three to six months’ worth of expenses in a liquid savings account.

-

Start small: Even setting aside $500 is a good start.

-

Avoid using the fund for non-emergencies to keep it intact.

4. Start Saving and Investing Early

The earlier you start saving and investing, the more time your money has to grow. Consider setting up automatic contributions to a retirement account, such as a 401(k) or IRA.

-

Invest in a mix of stocks, bonds, and mutual funds for long-term growth.

-

Take advantage of employer matches, especially in 401(k) plans.

5. Increase Your Income Streams

One of the most effective ways to accelerate your journey to financial freedom is by increasing your income. Consider taking on side gigs, freelance work, or starting your own business.

-

Passive income streams, such as dividends or rental properties, can provide long-term financial security.

-

Explore opportunities in the gig economy, such as ridesharing, freelancing, or online tutoring.

3. How to Invest for Financial Freedom

Investing is a powerful tool for building wealth and achieving financial freedom. Here are a few investment strategies to consider:

1. Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps reduce the impact of market volatility and lowers the average cost of investments over time.

-

Ideal for long-term investors who are less concerned with short-term fluctuations.

-

Perfect for setting up automatic contributions to mutual funds or ETFs.

2. Diversify Your Portfolio

To reduce risk and increase the potential for returns, it’s important to diversify your investment portfolio. This means spreading your investments across different asset classes, such as:

-

Stocks: High growth potential, but more volatile.

-

Bonds: Lower risk and stable returns.

-

Real estate: Tangible asset with the potential for long-term growth and passive income.

3. Invest in Real Estate

Real estate is a proven wealth-building strategy. Investing in rental properties or real estate investment trusts (REITs) can provide you with both appreciation and passive income.

-

Rental properties can generate consistent cash flow.

-

REITs allow you to invest in real estate without the need for property management.

4. The Importance of Financial Literacy

Financial literacy is the foundation of financial freedom. Understanding how money works, how to manage it, and how to invest it wisely will help you make informed decisions about your finances.

1. Learn the Basics of Personal Finance

Understanding the fundamentals of saving, budgeting, and investing will empower you to make better financial choices. There are many free resources, such as blogs, podcasts, and online courses, that can help you improve your financial literacy.

-

Books like Rich Dad Poor Dad or The Millionaire Next Door offer valuable insights into wealth-building.

-

Follow trusted personal finance blogs and financial advisors for the latest tips and advice.

2. Set Clear Financial Goals

Setting clear and achievable financial goals will keep you focused and motivated. Whether your goal is to save for retirement, pay off debt, or buy a house, having specific goals will help you stay on track.

-

Use a financial goals tracker to monitor your progress.

-

Break down large goals into smaller, more manageable milestones.

5. Frequently Asked Questions (FAQs)

1. How long does it take to achieve financial freedom?

The timeline for achieving financial freedom varies based on your current financial situation, goals, and actions. It can take anywhere from several years to a few decades, depending on your commitment to saving, investing, and managing debt.

2. Can I achieve financial freedom without a high income?

Yes! Achieving financial freedom doesn’t depend solely on your income but rather on how well you manage your expenses, save, and invest. Even those with moderate incomes can achieve financial independence through smart budgeting and disciplined investing.

3. What are the best investment options for beginners?

If you’re just starting, consider low-risk investments such as index funds, ETFs, or target-date funds. These are simple to manage and provide diversification with minimal effort.

4. Should I prioritize paying off debt or saving for the future?

It’s important to balance both. Paying off high-interest debt should be a priority, but saving for the future (such as retirement) should also be a part of your plan. Ideally, contribute to a retirement account while paying off debt to benefit from compound interest.

6. Conclusion

Achieving financial freedom is a journey that requires careful planning, discipline, and consistency. By following these financial freedom ideas, such as budgeting, saving, investing, and increasing your income, you’ll be well on your way to a secure and independent financial future. Remember, it’s never too late to start — take the first step today, and you’ll be closer to living the life you’ve always dreamed of.