The Best Wealth Apps: Tools to Build and Manage Your Financial Future

In today’s digital age, managing personal finances has become easier thanks to the rise of wealth apps. These applications help individuals take control of their financial planning, investments, and savings. Whether you’re looking to track your spending, invest in stocks, or plan for retirement, there’s an app for nearly every financial need. In this article, we’ll explore the best wealth apps available, highlighting their features, benefits, and how they can help you reach your financial goals.

Why Use Wealth Apps?

Wealth apps provide users with a convenient way to manage their finances directly from their smartphones or tablets. They can help you:

-

Track spending and create budgets.

-

Invest in various assets like stocks, ETFs, or cryptocurrencies.

-

Plan for retirement and set long-term financial goals.

-

Monitor net worth by linking all your accounts and investments in one place.

By using these apps, you gain access to tools that were once reserved for financial professionals. With detailed insights into your spending habits and personalized investment recommendations, wealth apps make financial management more accessible than ever.

Best Wealth Apps to Consider

Below is a list of some of the top wealth apps that can help you build and grow your wealth:

1. Mint: The All-in-One Financial Tracker

Mint is one of the most popular budgeting and expense tracking apps available today. It allows you to link all your accounts, including bank accounts, credit cards, and loans, in one place. The app then categorizes your expenses, tracks your income, and helps you stay on top of your financial goals.

Key Features:

-

Budgeting tools to manage your expenses.

-

Credit score tracking to monitor your financial health.

-

Bill reminders to avoid late fees.

Mint is ideal for individuals who want a simple, intuitive way to manage their finances, track spending, and plan budgets.

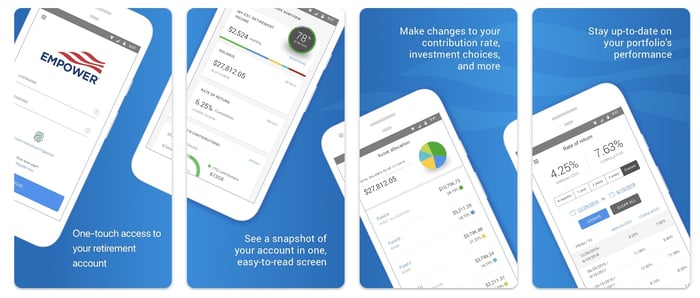

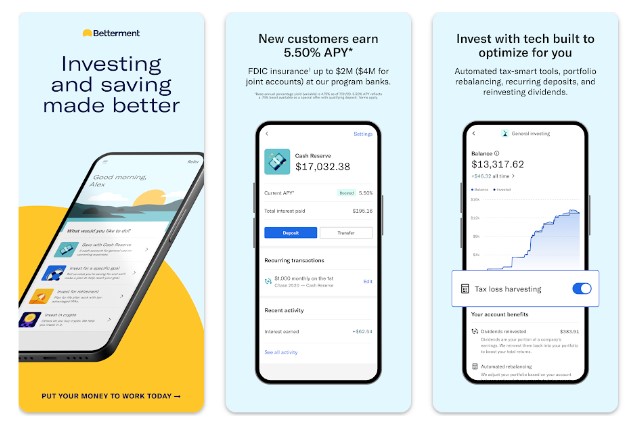

2. Betterment: Automated Investment Management

Betterment is a robo-advisor that offers automated investment services, helping you manage your portfolio with ease. It uses algorithms to build and manage a diversified portfolio based on your financial goals and risk tolerance.

Key Features:

-

Personalized portfolio management based on your goals.

-

Automatic rebalancing to maintain a diversified portfolio.

-

Tax-loss harvesting to minimize tax liability.

Betterment is a great choice for individuals who want to start investing without needing to be experts. It’s perfect for those who prefer a hands-off approach to managing investments.

3. Acorns: Invest Your Spare Change

Acorns is an innovative wealth-building app that rounds up your everyday purchases to the nearest dollar and invests the difference. This feature is ideal for those who want to invest but struggle to find the time or money to do so regularly.

Key Features:

-

Round-ups from daily purchases to invest spare change.

-

Portfolio diversification across stocks, bonds, and ETFs.

-

Automatic rebalancing to keep your portfolio in line with your goals.

Acorns is particularly helpful for beginners or those who may not have large amounts to invest but want to build wealth over time.

4. Personal Capital: Financial Planning and Investment Management

Personal Capital combines personal finance tracking with investment management. It offers tools to monitor your spending, track your investments, and plan for retirement. This app is ideal for users who want a comprehensive view of both their day-to-day finances and long-term financial planning.

Key Features:

-

Track spending and monitor budgets.

-

Investment tracking and analysis tools.

-

Retirement planning with future projections.

If you want to blend both budgeting and investment management, Personal Capital is an excellent choice for long-term financial planning.

5. Robinhood: Easy Stock Market Access

Robinhood is a commission-free trading app that makes investing in stocks, ETFs, options, and cryptocurrencies more accessible. The app is simple to use, allowing you to buy and sell stocks with no fees or commissions, making it popular among beginners and experienced investors alike.

Key Features:

-

No commissions or fees for trades.

-

Cryptocurrency trading in addition to stocks and ETFs.

-

Fractional shares to allow smaller investments in high-value stocks.

Robinhood is perfect for those who are looking to get started with stock market investing without paying hefty commissions or fees.

6. Wealthfront: Low-Cost Robo-Advisor

Wealthfront is another robo-advisor that offers automated investment management. It provides users with a low-cost way to diversify their investments, offering personalized portfolios based on goals like retirement, college savings, or wealth accumulation.

Key Features:

-

Goal-based investing tailored to your specific needs.

-

Tax-efficient investing with tax-loss harvesting.

-

Financial planning tools for retirement and college savings.

Wealthfront is ideal for individuals looking to invest for specific goals, with a focus on long-term growth and tax efficiency.

How Wealth Apps Can Help You Achieve Financial Freedom

The primary benefit of using wealth apps is that they can help you build a solid financial foundation, which is essential for achieving financial freedom. Here’s how they help:

-

Automated Investing: By using apps like Betterment and Acorns, you can invest regularly without thinking about it. This builds your wealth passively.

-

Financial Tracking: Apps like Mint and Personal Capital allow you to see where your money is going and adjust your spending accordingly.

-

Goal Setting: Most wealth apps allow you to set specific goals, such as saving for a home, paying off debt, or building an emergency fund.

-

Personalized Advice: Many apps offer personalized recommendations based on your financial situation and goals.

By consistently using these apps to track your spending, invest in assets, and plan for the future, you’ll be well on your way to financial freedom.

Tips for Maximizing Your Wealth with Apps

To make the most out of your wealth apps, consider the following tips:

-

Set clear financial goals: Whether it’s saving for a big purchase or retirement, having goals in mind will help you stay on track.

-

Invest regularly: Even small, regular investments can add up over time. Automate your savings and investments to make it easier.

-

Monitor your progress: Regularly review your budget, investment portfolio, and savings to ensure you’re meeting your financial goals.

FAQs about Wealth Apps

1. Are wealth apps safe to use?

Yes, most wealth apps use encryption to protect your data. However, it’s important to choose reputable apps and enable security features like two-factor authentication for extra protection.

2. Do wealth apps charge fees?

Many wealth apps are free to use, but some may charge fees for advanced features or investment services. Be sure to check for any fees before choosing an app.

3. Can wealth apps help with debt management?

While apps like Mint and Personal Capital focus more on budgeting and investing, they also offer tools to help you track debt payments and develop a plan to reduce debt over time.

4. Can I use multiple wealth apps?

Yes, you can use multiple apps simultaneously to manage different aspects of your financial life. For example, you can use Mint for budgeting and Acorns for investing.

5. Which wealth app is best for beginners?

Apps like Acorns and Mint are excellent for beginners because they are easy to use and offer educational resources to help you understand financial concepts.

Conclusion

Wealth apps are powerful tools that help individuals take control of their finances, track their spending, and invest for the future. Whether you’re just starting out or looking to improve your financial strategy, there’s an app that fits your needs. From budgeting tools to automated investing, these apps make managing your money more convenient and accessible than ever.

By choosing the right wealth apps and using them effectively, you can achieve your financial goals and build long-term wealth.