Best Stock Brokers: Top Picks for 2024

Choosing the right stock broker is essential for anyone looking to invest in the stock market. Whether you’re a beginner or an experienced trader, selecting the best broker can make a significant impact on your investment success. With so many options available, how do you choose the one that fits your needs? In this article, we’ll explore the top stock brokers for 2024, providing insights into their features, fees, and services.

1. What to Look for in a Stock Broker

Before diving into the best stock brokers, it’s important to know what to look for when making your decision. The right broker for you will depend on factors like fees, investment options, platform features, and customer service.

Key Considerations:

-

Fees and Commissions: Look for brokers with low commissions and no hidden fees. Some brokers offer commission-free trading, which is ideal for frequent traders.

-

Account Types: Different brokers offer various account types like retirement accounts, taxable accounts, and more. Make sure the broker supports the account type you need.

-

Platform Usability: A user-friendly platform is crucial for executing trades efficiently. Look for brokers with an intuitive interface, advanced charting tools, and real-time data.

-

Customer Service: Ensure the broker offers responsive customer support in case you need assistance.

Why This Matters:

Selecting a broker that aligns with your needs can help you minimize costs and maximize returns. Whether you’re just getting started or are a seasoned investor, having the right broker is key to your trading success.

2. Top Stock Brokers for 2024

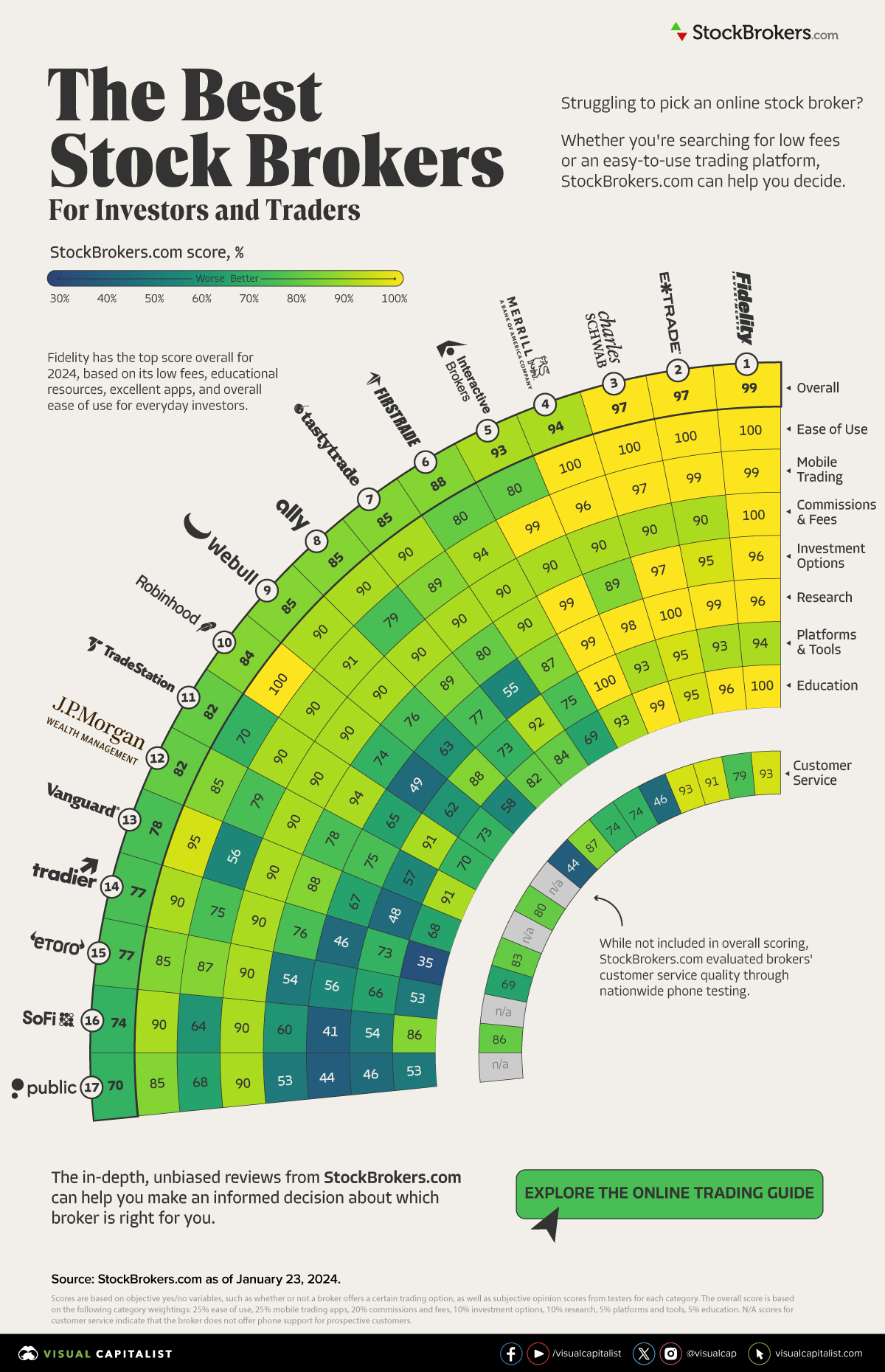

Here are the best stock brokers for 2024, based on their features, reputation, and customer satisfaction:

1. Charles Schwab

Charles Schwab is often regarded as one of the best all-around brokers. It offers a user-friendly platform, low fees, and a wide range of investment options. Schwab is great for both beginners and experienced traders.

-

Pros:

-

Commission-free trading for stocks and ETFs.

-

Access to research and educational resources.

-

No minimum deposit requirement.

-

-

Cons:

-

Limited selection of mutual funds.

-

Higher fees for some services compared to other brokers.

-

Best For: Investors looking for a reliable, well-rounded platform with excellent customer service.

2. Fidelity Investments

Fidelity is another great choice, especially for those focused on retirement savings. It offers low fees, a variety of investment options, and robust research tools.

-

Pros:

-

$0 commissions on stocks and ETFs.

-

Exceptional research and educational tools.

-

Great for retirement accounts like IRAs and 401(k)s.

-

-

Cons:

-

Some advanced features may be overwhelming for beginners.

-

Higher margin rates.

-

Best For: Long-term investors and those looking to save for retirement.

3. TD Ameritrade

TD Ameritrade is known for its comprehensive trading platform, which includes everything from stocks to cryptocurrency trading. It’s ideal for both beginners and advanced traders, offering access to advanced tools and features.

-

Pros:

-

Extensive educational resources for beginners.

-

Access to a wide range of investment options, including options and futures.

-

Strong customer support.

-

-

Cons:

-

Some fees can be high for advanced features.

-

Platform can be complex for novice traders.

-

Best For: Traders looking for a wide range of tools and educational content.

4. E*TRADE

E*TRADE is perfect for active traders due to its powerful trading tools and platforms. It offers a mobile app that’s perfect for trading on the go.

-

Pros:

-

Excellent mobile trading app.

-

Wide selection of investment products, including bonds and mutual funds.

-

Low fees on most trades.

-

-

Cons:

-

Limited research tools compared to competitors.

-

Higher fees on some mutual funds.

-

Best For: Active traders who need a powerful trading platform.

5. Robinhood

Robinhood is known for commission-free trades and its simple, easy-to-use mobile app. It’s a great platform for beginners looking to start trading with little upfront cost.

-

Pros:

-

Zero commission fees for stocks, options, and crypto trades.

-

No minimum deposit required.

-

Easy-to-use mobile interface.

-

-

Cons:

-

Limited research tools and educational resources.

-

Customer service can be slow at times.

-

Best For: Beginners who want an easy entry point into the stock market.

6. Interactive Brokers

Interactive Brokers is best for experienced traders who need access to advanced trading tools. This platform offers global market access, allowing users to trade in various asset classes.

-

Pros:

-

Access to global markets and advanced trading tools.

-

Low margin rates and competitive commissions.

-

Wide selection of investment products.

-

-

Cons:

-

Complex platform that may be overwhelming for beginners.

-

High account minimums.

-

Best For: Experienced traders who need global access and advanced tools.

3. How to Choose the Right Stock Broker for You

Choosing the right stock broker is a highly personal decision. Start by evaluating your investment goals. Are you a beginner or an experienced investor? Do you prefer a simple platform or one with advanced features?

Key Questions to Ask:

-

What type of investor are you? Long-term or short-term? Beginner or experienced?

-

What fees are acceptable to you? Do you want commission-free trading, or are you willing to pay higher fees for advanced features?

-

What tools and resources do you need? Look for brokers that provide research, educational resources, and reliable customer support.

4. Benefits of Using a Stock Broker

Using a reputable stock broker comes with several advantages:

-

Access to Research: Most brokers provide in-depth research and tools to help you make informed decisions.

-

Convenience: Brokers handle all the behind-the-scenes tasks, like executing trades, helping you focus on investing.

-

Diversification: Brokers offer access to a wide variety of investment options, allowing you to diversify your portfolio and minimize risk.

5. Frequently Asked Questions (FAQs)

1. How do I choose the best stock broker?

The best broker for you depends on factors like fees, account types, and platform features. For beginners, choose a broker with low fees and strong educational resources, like Fidelity or Charles Schwab. For active traders, consider platforms with advanced tools, such as TD Ameritrade or Interactive Brokers.

2. What is the cheapest stock broker?

Some of the cheapest stock brokers include Robinhood and Webull, which offer commission-free trades. However, be sure to consider other factors, such as platform usability and customer service, when choosing a broker.

3. Can I trade stocks without a broker?

While it’s possible to trade stocks directly through Direct Stock Purchase Plans (DSPPs) or through company-sponsored plans, using a broker provides more flexibility, resources, and access to the broader market.

4. Are there any hidden fees with stock brokers?

Many brokers now offer commission-free trading, but there may still be hidden fees for things like margin trading, mutual funds, or withdrawals. Be sure to review the fee schedule before committing to a broker.

5. Can I start investing with a small amount of money?

Yes, many brokers allow you to start investing with as little as $1. Platforms like Robinhood and Charles Schwab offer fractional shares, enabling you to buy portions of stocks instead of whole shares.

Conclusion

Choosing the best stock broker for your needs is crucial for long-term investment success. By evaluating factors like fees, available features, and customer support, you can find the right broker that fits your investment style. Whether you’re just starting or are an experienced trader, there’s a platform out there that meets your needs.

Take the time to compare different brokers, use the tools and resources available, and start building your investment portfolio today.