Best Insurance Plans: A Complete Guide to Finding the Right Coverage for You

Choosing the right insurance plan is a crucial decision that can provide financial security and peace of mind in times of need. Whether you’re looking for health insurance, life insurance, or auto insurance, finding a plan that fits your needs and budget is essential. In this article, we’ll explore some of the best insurance plans available in 2025, focusing on different types of coverage, their benefits, and how to select the best plan for you.

Why Is Insurance Important?

Insurance is a safety net that helps you manage the financial risks associated with unexpected events. Whether you’re faced with a medical emergency, a car accident, or the loss of a loved one, the right insurance plan can help you recover financially. Without proper insurance, you may face significant out-of-pocket expenses that can affect your financial stability.

There are many types of insurance, and each offers its own set of benefits. Health insurance, for example, can help cover medical expenses, while life insurance provides financial support for your family in the event of your passing. Choosing the right insurance is a step toward ensuring that you’re prepared for the unexpected.

Types of Insurance Plans

Insurance comes in various forms, and the type you need will depend on your personal situation and goals. Below are some of the most common types of insurance plans:

1. Health Insurance

Health insurance is one of the most important types of coverage you can have. It helps cover medical expenses, including hospital stays, doctor visits, surgeries, and prescriptions. Without health insurance, a serious illness or injury can quickly lead to financial hardship.

Health insurance plans come with various options, such as individual health plans, family floater policies, and critical illness insurance. The best health insurance plans offer comprehensive coverage, affordable premiums, and access to a wide network of hospitals.

2. Life Insurance

Life insurance provides financial protection for your loved ones in the event of your death. It ensures that your family is taken care of and can cover funeral costs, outstanding debts, and living expenses. There are two main types of life insurance: term life insurance and whole life insurance.

Term life insurance offers coverage for a specific period, typically 10, 20, or 30 years. It’s generally more affordable and is ideal for those who need coverage for a limited time. Whole life insurance, on the other hand, provides lifelong coverage and often includes an investment component.

3. Auto Insurance

Auto insurance is required by law in most places and helps protect you financially if you’re involved in a car accident. It covers damages to your vehicle, injuries to you or others, and liability costs if you’re found at fault in an accident. There are several types of auto insurance, including:

-

Liability coverage: Covers damage to others in an accident where you’re at fault.

-

Collision coverage: Pays for repairs to your car after an accident, regardless of fault.

-

Comprehensive coverage: Covers damage to your car from non-collision incidents like theft, vandalism, or natural disasters.

4. Homeowners Insurance

Homeowners insurance protects your home and belongings in the event of damage from fire, theft, or natural disasters. It also provides liability coverage in case someone is injured on your property. Homeowners insurance typically covers:

-

Dwelling coverage: Repairs to your home.

-

Personal property coverage: Damages or loss of personal belongings.

-

Liability coverage: Legal costs if someone is injured on your property.

How to Choose the Best Insurance Plan for You

Choosing the right insurance plan can be overwhelming with so many options available. Here are a few steps to help you make the right decision:

1. Assess Your Needs

Start by assessing your personal needs. Are you looking for health insurance to cover medical expenses, or do you need life insurance to secure your family’s future? Understanding your unique situation will help you choose the right plan.

2. Compare Plans

Once you know what type of insurance you need, compare plans from different providers. Look at factors such as:

-

Premiums: The amount you’ll pay regularly for coverage.

-

Coverage: What is and isn’t covered under the policy.

-

Deductibles: The amount you must pay out-of-pocket before insurance kicks in.

-

Exclusions: Any conditions or situations that aren’t covered.

3. Check for Network and Benefits

For health insurance, make sure the plan includes a wide network of doctors and hospitals. For auto insurance, check if the plan provides adequate roadside assistance and claims support.

4. Read Customer Reviews

Before finalizing your decision, read customer reviews of the insurance provider. Look for feedback on claim satisfaction, customer service, and overall experience. Sites like Trustpilot and Feefo can be valuable resources for reviews.

Top Insurance Plans in 2025

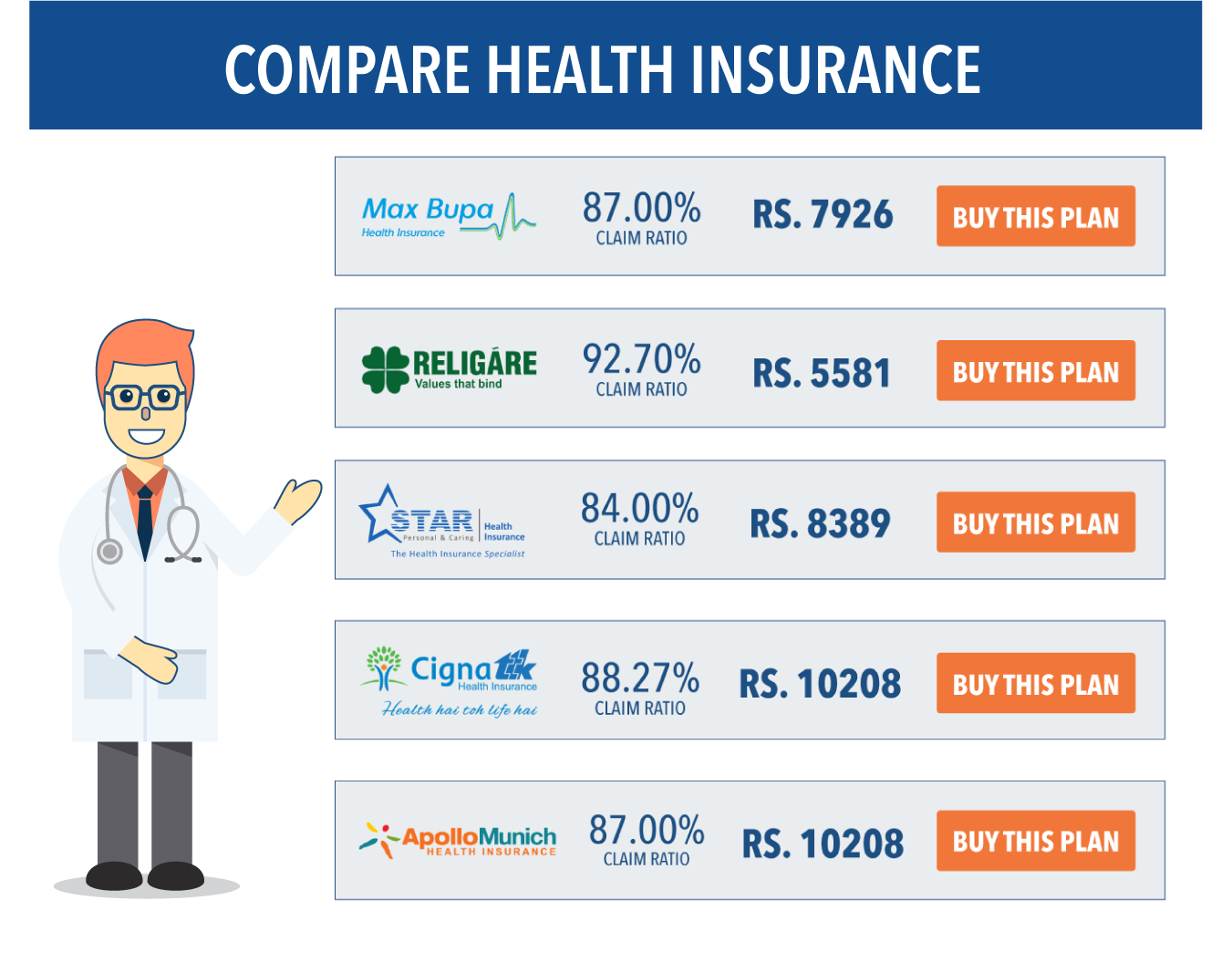

Here are some of the best insurance plans available today, based on customer satisfaction, affordability, and comprehensive coverage:

1. Max Bupa Health Insurance

Max Bupa offers some of the most comprehensive health insurance plans in the market. Their policies cover a wide range of medical expenses, including hospitalization, surgeries, and critical illnesses. Max Bupa also provides a variety of add-on benefits like maternity coverage and pre and post-hospitalization expenses.

2. LIC Jeevan Anand

LIC Jeevan Anand is a popular life insurance plan in India. It offers both protection and investment benefits, making it an excellent choice for individuals looking to secure their family’s future while also building wealth. With affordable premiums and flexible terms, it is suitable for people of all ages.

3. Bajaj Allianz Comprehensive Motor Insurance

Bajaj Allianz provides excellent auto insurance coverage, including third-party liability, accident protection, and vehicle damage. Their plans also come with a cashless claim option, making it easy to get your vehicle repaired without any out-of-pocket expenses.

4. HDFC ERGO Home Insurance

HDFC ERGO offers one of the best home insurance plans available today. Their policies cover a wide range of damages, including fire, theft, and natural disasters. They also offer liability coverage, protecting you in case someone gets injured on your property.

FAQs About Insurance Plans

What is the best insurance plan for health?

The best health insurance plan depends on your needs and budget. Max Bupa Health Insurance is known for its comprehensive coverage and additional benefits like maternity coverage and wellness checks.

How do I choose the right life insurance?

To choose the right life insurance, consider whether you need term life insurance for temporary coverage or whole life insurance for lifelong protection. Also, ensure the premium fits your budget.

Is auto insurance mandatory?

In most countries, auto insurance is required by law. It provides financial protection in case of accidents, covering damages to your car and others involved in the accident.

How can I reduce my health insurance premiums?

You can reduce your health insurance premiums by choosing a higher deductible, opting for family floater policies, or purchasing a policy that excludes coverage for less essential services.

Conclusion: Secure Your Future with the Right Insurance Plan

Choosing the right insurance plan is a crucial step in securing your financial future. Whether you’re looking for health insurance, life insurance, or auto insurance, it’s important to assess your needs, compare plans, and select the best option for your situation.

By carefully considering your options, reading customer reviews, and choosing comprehensive coverage, you can ensure that you’re adequately protected against life’s unexpected events. Make sure to explore the best options available, like Max Bupa Health Insurance or LIC Jeevan Anand, to find the perfect coverage for your needs.