Best Forex Platforms: Choosing the Right One for Your Trading Success

When it comes to trading in the foreign exchange (forex) market, selecting the right forex platform can make a significant difference in your success. The forex market is one of the largest financial markets globally, with a daily trading volume exceeding $6 trillion. Whether you’re a beginner or an experienced trader, choosing a platform that aligns with your needs and preferences is crucial.

In this article, we’ll explore the best forex platforms available today, considering factors such as user-friendliness, fees, features, and security. Let’s dive into the world of forex trading platforms, and help you find the one that best suits your trading style.

1. What to Look for in a Forex Platform

Choosing the best forex platform can be overwhelming due to the vast number of options available. However, by considering the following key factors, you can narrow down your choices and select a platform that suits your trading goals.

User Interface

A clean and intuitive user interface is essential for traders of all levels. The platform should be easy to navigate, even for beginners. Look for platforms that offer customizable charts, indicators, and real-time data to make your trading experience more efficient.

Security

Since you’ll be dealing with significant financial transactions, security is paramount. The best forex platforms use advanced encryption methods and adhere to strict regulatory standards to protect your personal and financial information.

Trading Tools and Features

Look for platforms that offer a variety of trading tools and features, such as automated trading, real-time market analysis, and risk management tools. These features can help you make informed decisions and manage your trades more effectively.

Fees and Spreads

Forex trading platforms often charge fees in the form of spreads or commissions. Be sure to compare the costs associated with each platform to ensure you’re getting a fair deal. Some platforms also offer zero commission trading, which can be an attractive option for frequent traders.

Customer Support

Efficient customer support can make a huge difference, especially when you encounter technical issues or have questions about your trades. Look for platforms that offer multiple support channels, including live chat, email, and phone support.

2. Top 5 Best Forex Platforms

Now that we’ve covered what to look for in a forex platform, let’s explore the top platforms that stand out for their features, security, and reliability.

1. MetaTrader 4 (MT4)

MetaTrader 4 is one of the most popular forex platforms, known for its user-friendly interface and robust features. It’s widely used by both beginner and experienced traders due to its advanced charting tools, automated trading options, and extensive library of indicators.

-

Key Features:

-

One-click trading

-

Advanced charting and analysis tools

-

Large selection of indicators

-

Automated trading with Expert Advisors (EAs)

-

2. MetaTrader 5 (MT5)

MetaTrader 5 is the successor to MT4, offering more advanced features and greater flexibility. While it retains most of the features of MT4, it includes additional tools, such as more timeframes, better charting capabilities, and a built-in economic calendar.

-

Key Features:

-

Advanced charting tools

-

Built-in economic calendar

-

Supports more order types

-

Faster order execution

-

Multi-currency support

-

3. NinjaTrader

NinjaTrader is a comprehensive trading platform designed for both forex and futures trading. It provides advanced features for traders who want to utilize technical analysis, automated trading, and market insights. It’s known for its excellent charting features and market depth analysis tools.

-

Key Features:

-

Customizable charting options

-

Extensive research tools

-

Automated trading capabilities

-

Free demo accounts for practice

-

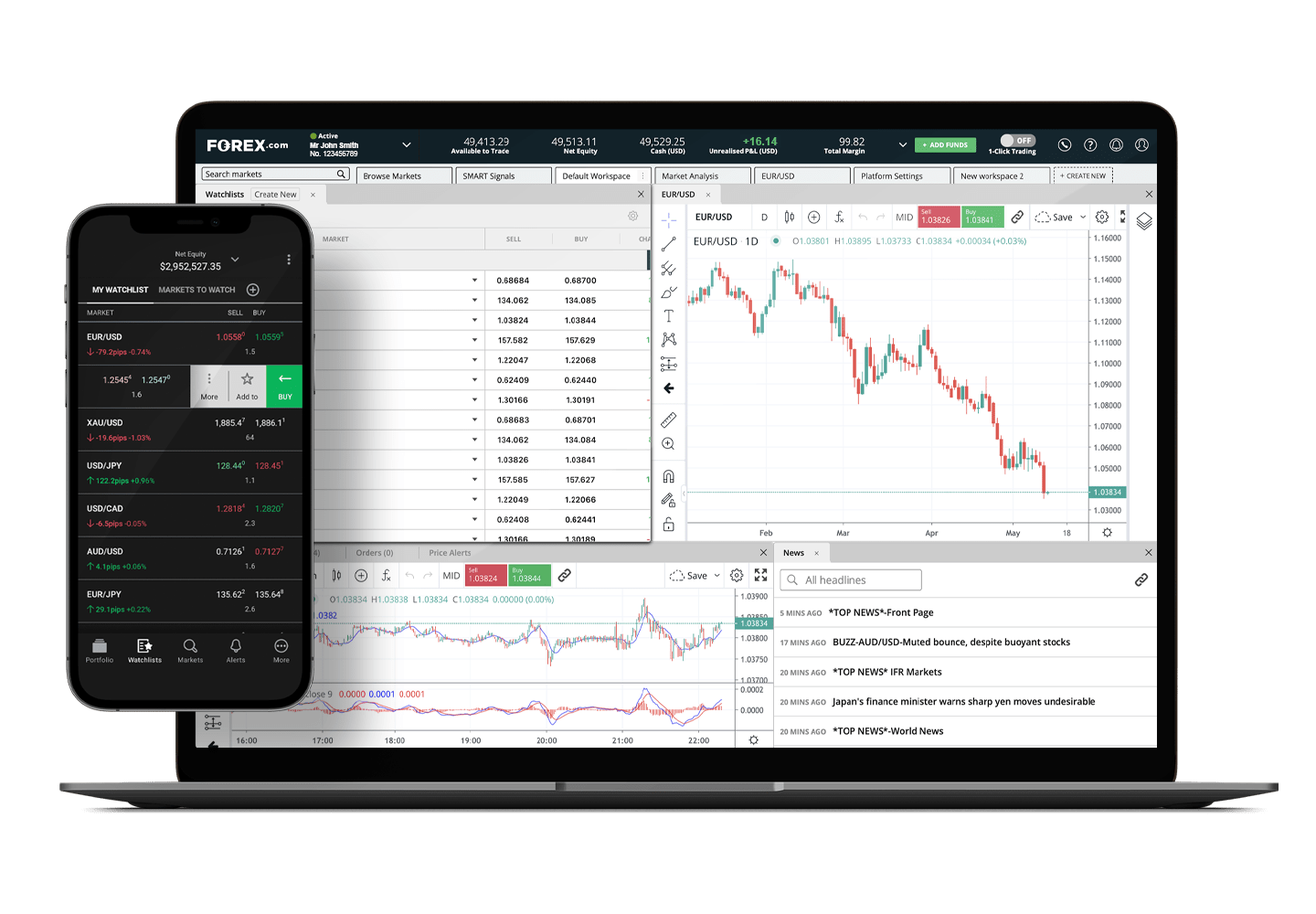

4. Forex.com

Forex.com is a reliable and widely trusted platform for forex traders. It offers competitive spreads, advanced trading tools, and a user-friendly interface. The platform is regulated in multiple countries, ensuring that your funds are secure.

-

Key Features:

-

Wide range of currency pairs

-

Low spreads for active traders

-

Excellent educational resources

-

Access to both MetaTrader 4 and their proprietary platform

-

5. cTrader

cTrader is another top-tier platform designed for forex and CFD trading. Known for its fast execution speeds, intuitive interface, and cutting-edge charting tools, cTrader is perfect for traders looking for a seamless experience.

-

Key Features:

-

Fast order execution

-

Advanced charting and analysis tools

-

Multiple order types

-

Social trading and copy trading options

-

3. Benefits of Using Forex Platforms

Using a dedicated forex platform can offer numerous benefits over trading through a traditional brokerage. Here are some advantages of using a specialized forex trading platform:

1. Access to Real-Time Market Data

Forex platforms provide real-time market data, which is essential for making quick and informed trading decisions. With the forex market operating 24/5, timely updates can make a significant difference in your trading strategy.

2. Advanced Trading Tools

Most forex platforms come with built-in tools that help traders analyze the market, predict trends, and manage risk. Tools such as technical analysis, indicators, and charting software give traders the edge they need to make profitable trades.

3. Lower Fees

Many forex platforms offer lower trading costs compared to traditional brokers, making them an attractive option for frequent traders. Platforms like Forex.com and cTrader offer tight spreads and competitive commission rates.

4. Forex Trading: Key Tips for Success

To make the most out of your forex trading experience, it’s essential to follow a few key tips that can help you succeed in this highly volatile market.

1. Start with a Demo Account

Before diving into real-money trading, it’s a good idea to practice with a demo account. This will allow you to familiarize yourself with the platform and develop your trading skills without the risk.

2. Focus on Risk Management

Risk management is crucial in forex trading. Always set stop-loss orders to limit your potential losses and never risk more than you can afford to lose. Using proper position sizing will also help reduce the risk of significant losses.

3. Stay Informed

The forex market is influenced by a variety of factors, including economic data, geopolitical events, and market sentiment. Stay up to date on global events to understand how they may affect currency pairs.

5. Frequently Asked Questions (FAQs)

1. What is the best forex platform for beginners?

Platforms like MetaTrader 4 and Forex.com are ideal for beginners due to their easy-to-use interface, educational resources, and demo accounts.

2. Are forex platforms regulated?

Yes, many forex platforms are regulated by financial authorities such as the FCA (UK), ASIC (Australia), and NFA (USA), ensuring they adhere to strict security and financial standards.

3. Can I use a forex platform on my mobile device?

Most top forex platforms, including MetaTrader 4, NinjaTrader, and Forex.com, offer mobile apps that allow you to trade on the go.

4. How do I choose the best forex platform for my needs?

When choosing a forex platform, consider factors like user interface, security features, fees, and available tools. Additionally, test out demo accounts to ensure the platform suits your trading style.

5. Is forex trading profitable?

Forex trading can be profitable, but it requires experience, knowledge, and the right strategy. Many successful traders focus on risk management and continually refine their skills.

Conclusion

Selecting the best forex platform is crucial to your trading success. Platforms like MetaTrader 4, Forex.com, and cTrader offer great features, security, and accessibility for traders of all levels. By considering factors like ease of use, available tools, and security, you can choose a platform that aligns with your trading goals. Always remember to practice sound risk management and stay informed about market trends to increase your chances of success in the dynamic world of forex trading.