Financial Literacy Tips: A Guide to Better Money Management

Understanding financial literacy is essential for anyone looking to manage their money wisely, build wealth, and achieve financial goals. From budgeting to investing, having a strong grasp of financial concepts can make a significant difference in your financial journey. In this article, we’ll provide practical financial literacy tips to help you take control of your finances, regardless of where you’re starting from.

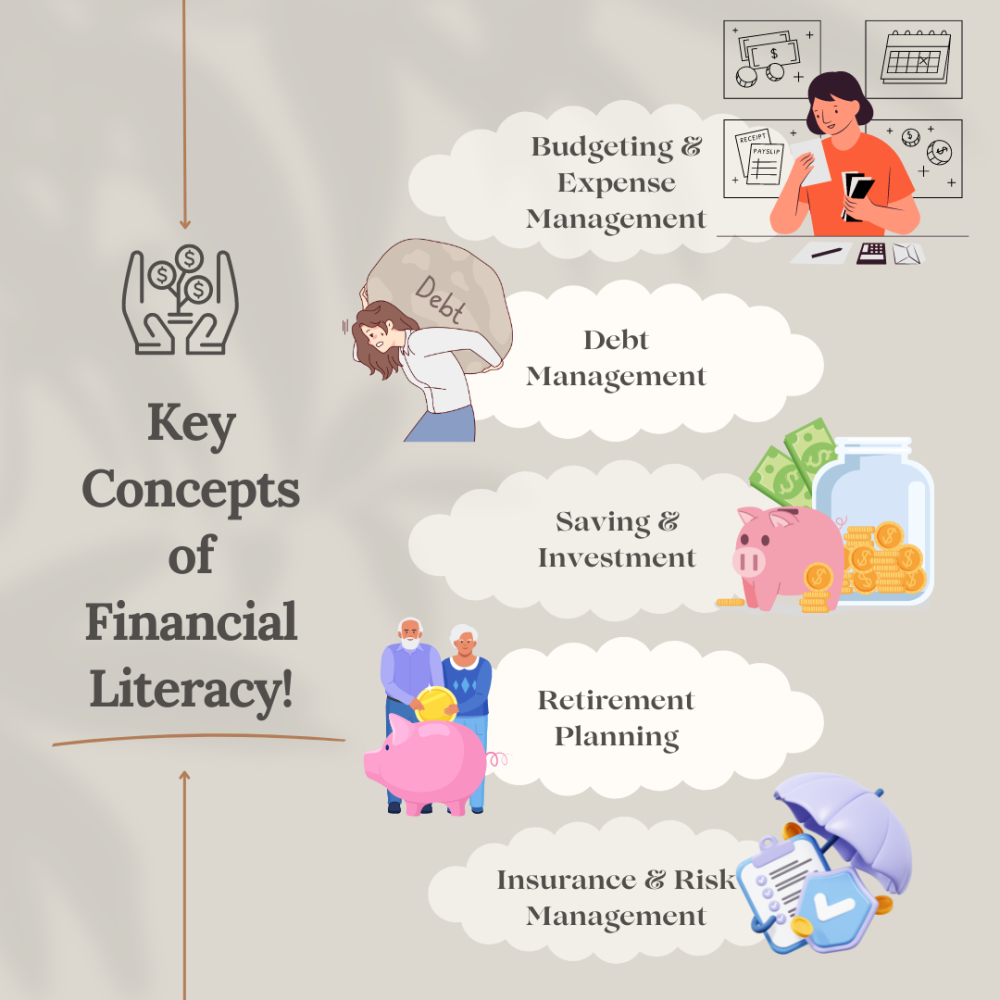

1. Why Financial Literacy is Important

Financial literacy isn’t just about understanding numbers. It’s about knowing how to make informed decisions that will affect your financial health in the long term. Without a solid foundation in financial concepts, it’s easy to fall into debt, miss opportunities for investment, and even make costly mistakes.

The Benefits of Financial Literacy:

-

Better Money Management: With financial literacy, you can effectively manage your income, expenses, and savings, leading to a more balanced financial life.

-

Increased Confidence: Understanding financial terms, investment options, and strategies makes you more confident in making decisions for your future.

-

Wealth Building: Financial literacy allows you to make smarter choices with your money, helping you invest wisely and grow your wealth over time.

2. Start with Budgeting

One of the first steps to financial freedom is creating a budget. Budgeting is essential because it gives you control over your money. It allows you to track where your money is going and adjust accordingly.

How to Create a Budget:

-

Track Your Income: Start by understanding how much money you bring in every month, including your salary and any other income sources.

-

List Your Expenses: Write down all your fixed and variable expenses. Fixed expenses include things like rent or mortgage payments, while variable expenses can include food, entertainment, and utilities.

-

Set Financial Goals: Decide what you want to achieve with your money—whether it’s paying off debt, saving for an emergency fund, or planning for retirement.

-

Cut Unnecessary Spending: Look for areas where you can cut back, such as dining out or subscriptions you no longer use.

By keeping a budget, you can easily see where your money is going and ensure you’re not spending more than you earn.

3. Build an Emergency Fund

Life is unpredictable, and having an emergency fund can help protect you from unexpected expenses, such as medical bills or job loss. Financial experts recommend having at least three to six months’ worth of living expenses saved up.

Steps to Build an Emergency Fund:

-

Start Small: Begin by setting aside a small percentage of your monthly income. Even $50 to $100 can add up over time.

-

Use a Separate Account: Keep your emergency fund in a separate savings account so you’re not tempted to dip into it for non-emergencies.

-

Reassess Regularly: Periodically review your emergency fund to make sure it’s adequate for your lifestyle and expenses.

An emergency fund is a financial cushion that can give you peace of mind during tough times.

4. Understanding Debt and Credit

Having debt is common, but it’s important to manage it wisely. Whether it’s credit card debt, student loans, or a mortgage, understanding how to handle debt and credit is crucial to maintaining financial health.

Tips for Managing Debt:

-

Pay Off High-Interest Debt First: Focus on paying off high-interest debt, such as credit card balances, before tackling lower-interest loans.

-

Avoid Taking on Unnecessary Debt: Before taking out a loan, make sure you can afford the payments and that it will benefit you in the long run.

-

Check Your Credit Score: Your credit score can affect your ability to get loans, credit cards, and even certain jobs. Regularly check your credit score to ensure it’s in good standing.

How to Build Credit:

-

Pay Bills On Time: Timely bill payments can help improve your credit score.

-

Use Credit Responsibly: Try not to use more than 30% of your available credit limit.

5. Start Investing Early

Investing is a key component of wealth building. The earlier you start, the more time your money has to grow. You don’t need to be an expert to start investing; even small contributions to your investment portfolio can yield significant returns over time.

Different Types of Investments:

-

Stocks: Buying shares in companies gives you ownership and the potential for long-term growth.

-

Bonds: Bonds are loans to governments or corporations that pay interest over time.

-

Mutual Funds: A collection of investments, including stocks and bonds, that allows you to diversify your portfolio.

Tips for New Investors:

-

Start with Low-Cost Index Funds: These funds track the performance of a market index and are a great way to get started with investing.

-

Diversify Your Portfolio: Spread your investments across different asset classes to reduce risk.

-

Use Tax-Advantaged Accounts: Consider using IRAs or 401(k)s to reduce your tax burden while investing.

6. Plan for Retirement Early

It may feel like retirement is far off, but the earlier you start planning for it, the better. Thanks to the power of compound interest, your savings will grow significantly over the years if you start early.

Ways to Save for Retirement:

-

401(k): If your employer offers a 401(k) match, contribute enough to get the full match—it’s essentially free money.

-

IRA (Individual Retirement Account): An IRA offers tax advantages and is a great way to save for retirement independently of your employer.

-

Roth IRA: Contributions to a Roth IRA are made with after-tax dollars, but your earnings grow tax-free.

Starting early and being consistent with your contributions can ensure you have enough funds for a comfortable retirement.

7. Improve Financial Literacy with Ongoing Education

Financial literacy is a lifelong journey. As your financial situation changes, it’s important to continue educating yourself about new financial strategies and tools.

Ways to Stay Educated:

-

Read Financial Blogs: Websites like Investopedia and The Balance provide helpful articles and updates on financial topics.

-

Attend Financial Workshops: Many communities and financial institutions offer free workshops to help improve financial literacy.

-

Use Financial Apps: Apps like Mint or YNAB (You Need a Budget) can help you track spending, set goals, and educate yourself about managing money.

The more you learn, the more confident and capable you’ll be in making financial decisions.

8. Financial Literacy Resources

There are many resources available for those looking to improve their financial literacy. Below are a few trusted platforms and tools to get you started:

-

Financial Literacy Month: A month dedicated to educating people about financial management. Take advantage of this time to improve your understanding of money.

-

Books on Personal Finance: Some great reads include “The Millionaire Next Door” by Thomas Stanley and William Danko, and “Rich Dad Poor Dad” by Robert Kiyosaki.

-

Online Courses: Platforms like Coursera and Udemy offer courses on personal finance, investing, and money management.

9. Frequently Asked Questions (FAQs)

1. How can I improve my financial literacy?

Start by reading books, attending workshops, and using online resources like Investopedia. Financial apps and blogs are also great tools to stay updated.

2. What is the best way to budget?

Track your income and expenses using a budgeting app or a simple spreadsheet. Focus on cutting unnecessary spending and saving a portion of your income each month.

3. How can I save for retirement?

Contribute to a 401(k) or IRA, and start as early as possible to take advantage of compound interest. Maximize employer matching if available.

4. How do I start investing?

Start with low-cost index funds or ETFs and gradually diversify your portfolio. Make sure to invest for the long term and avoid chasing quick returns.

5. Why is financial literacy important?

Financial literacy empowers you to make informed decisions, avoid debt traps, and work towards financial independence and wealth-building.

Conclusion

Mastering financial literacy is an ongoing process, but by following these tips, you can take control of your finances and make informed decisions for your future. Whether you’re starting a budget, building an emergency fund, or planning for retirement, each step you take towards improving your financial literacy will bring you closer to achieving your financial goals.

By implementing these tips and continuously educating yourself, you’ll be on your way to a financially secure and successful future.