Best Mortgage Rates: A Complete Guide to Finding the Right Deal

Finding the best mortgage rates is crucial for securing a financially sound home loan. Whether you’re a first-time buyer or looking to refinance, understanding the various types of mortgage rates available and how to compare them can save you thousands over the life of your loan. In this article, we’ll break down the key factors affecting mortgage rates, how to find the best deals, and tips for securing the lowest possible rate.

Understanding Mortgage Rates

Mortgage rates represent the interest charged by lenders for borrowing money to purchase a home. These rates can vary significantly depending on several factors, including economic conditions, your credit score, the type of mortgage, and the loan term.

A lower interest rate means you’ll pay less in interest over the life of the loan, so finding the best rate is one of the most important steps in the home-buying process.

Fixed-Rate vs. Adjustable-Rate Mortgages

When shopping for a mortgage, you’ll typically encounter two main types of loan structures: fixed-rate and adjustable-rate mortgages (ARMs).

-

Fixed-rate mortgages offer a consistent interest rate for the entire term of the loan, typically 15, 20, or 30 years. This makes budgeting easier because your payments won’t change over time.

-

Adjustable-rate mortgages (ARMs) have a rate that fluctuates after an initial period, usually 5, 7, or 10 years. ARMs often start with a lower interest rate, but they can increase over time, making them riskier than fixed-rate loans.

Both types have their advantages, depending on your long-term plans and tolerance for risk.

Factors That Affect Mortgage Rates

Understanding the factors that impact mortgage rates is essential for securing the best deal. The following variables play a major role in determining your rate:

-

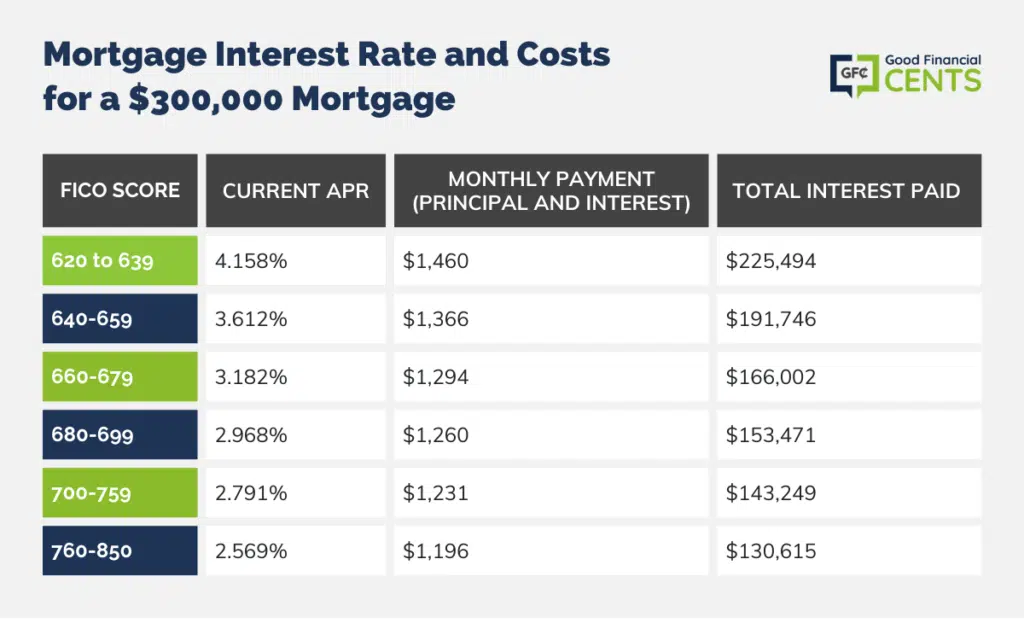

Credit Score: Lenders use your credit score to gauge the likelihood of you repaying the loan. A higher credit score typically means a lower interest rate.

-

Loan Amount: Larger loans tend to have higher rates, while smaller loans may qualify for lower rates.

-

Loan-to-Value Ratio (LTV): The LTV ratio is the amount of the loan compared to the value of the home. A lower LTV often results in a better rate because it reduces the lender’s risk.

-

Economic Conditions: Central banks, like the Federal Reserve, influence mortgage rates through their monetary policy. When interest rates rise, mortgage rates often follow suit.

How to Find the Best Mortgage Rates

Finding the best mortgage rate requires diligent research and comparison. Follow these steps to secure the most favorable terms for your home loan.

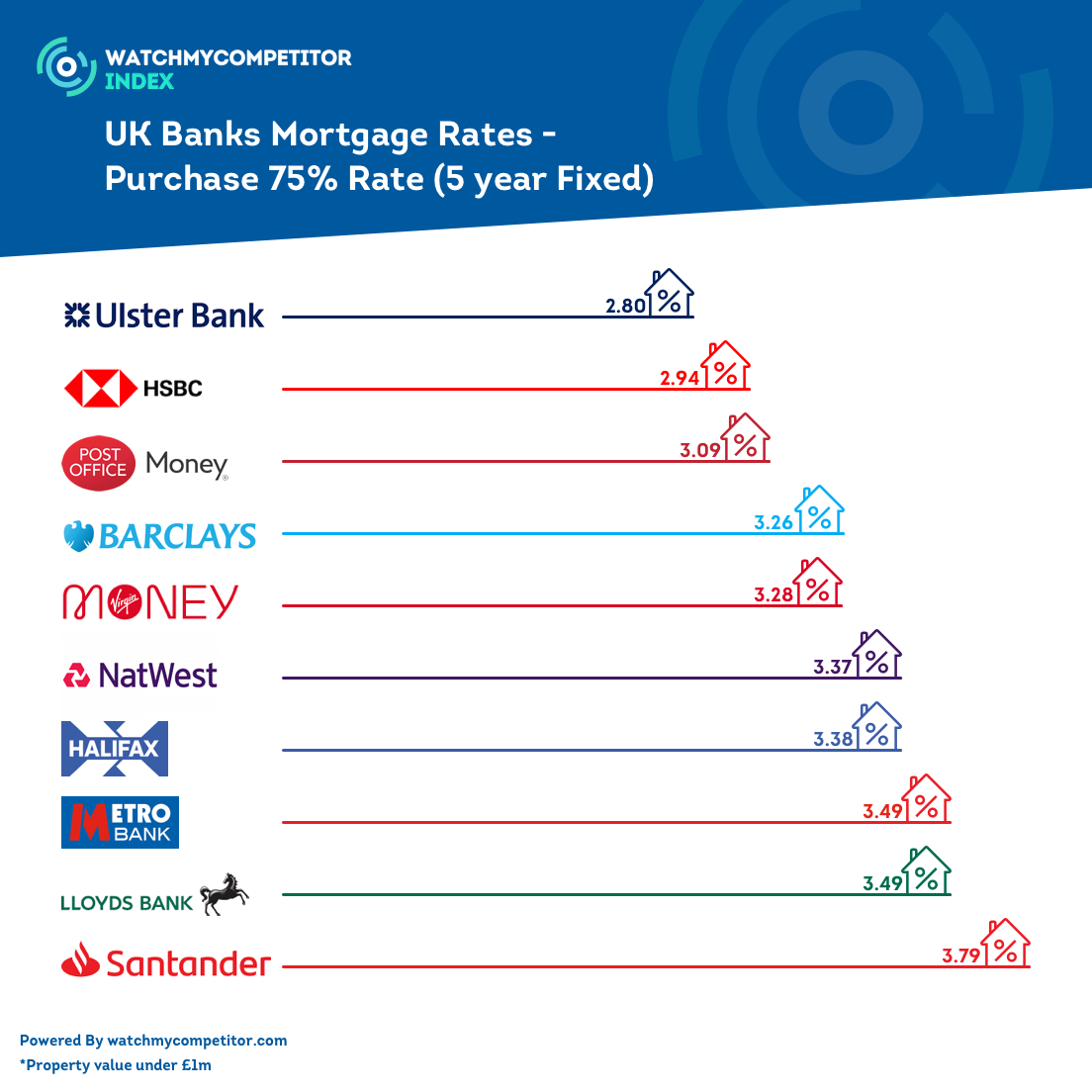

1. Shop Around for Quotes

The first step is to obtain quotes from multiple lenders. Don’t settle for the first rate you’re offered. By comparing rates from banks, credit unions, and online lenders, you can identify the best deal.

Consider using a mortgage broker if you want expert help navigating the process. Brokers can provide access to a wide variety of lenders and help you find competitive rates.

2. Check Your Credit Score

Your credit score has a significant impact on the interest rate you’ll receive. Before applying for a mortgage, check your score and take steps to improve it if necessary. A higher score can help you qualify for better rates.

To boost your credit score:

-

Pay down existing debt

-

Avoid opening new credit accounts

-

Resolve any errors on your credit report

3. Consider the Type of Mortgage

When you apply for a mortgage, you’ll be offered different types of loans. A fixed-rate mortgage offers stability, while an adjustable-rate mortgage (ARM) might offer a lower initial rate. Evaluate the pros and cons of both types based on your long-term plans and financial situation.

Pros and Cons of Fixed-Rate vs. ARMs:

-

Fixed-rate mortgages:

-

Pros: Predictable payments, no surprises.

-

Cons: Higher initial rates compared to ARMs.

-

-

ARMs:

-

Pros: Initial lower rates.

-

Cons: Rates can increase, leading to higher payments over time.

-

4. Consider the Loan Term

Shorter loan terms, such as 15 or 20 years, typically come with lower interest rates compared to longer loan terms like 30 years. However, monthly payments for shorter terms will be higher. If you can afford the higher payments, opting for a shorter term could save you a significant amount in interest.

Current Trends in Mortgage Rates

Mortgage rates fluctuate based on a variety of economic factors. Understanding current trends can help you time your home purchase or refinance for the best possible rate.

Historical Trends

Mortgage rates are influenced by the overall economic environment. For instance, when the Federal Reserve raises its benchmark interest rates, mortgage rates tend to rise as well. Conversely, when the economy slows down, the Fed may lower rates, which can reduce mortgage rates.

Looking at historical data, we can see how mortgage rates have changed over time. For example, in recent years, mortgage rates have been relatively low, creating a favorable environment for buyers.

However, market conditions can change rapidly, and it’s important to stay updated on current mortgage rate trends. Regularly checking reputable sources like Investopedia or banks.com can provide you with the latest information.

How to Lock in a Low Rate

If you’ve found a mortgage rate that meets your needs, consider locking it in. Mortgage rate locks typically last 30 to 60 days and protect you from future rate increases during the approval process.

What to Expect in 2024

As of recent reports, mortgage rates are projected to fluctuate as the economy continues to recover. If you’re considering buying a home or refinancing in the near future, it’s wise to keep an eye on these developments.

Frequently Asked Questions (FAQs)

1. What is the best mortgage rate I can get?

The best mortgage rate depends on several factors, including your credit score, the loan amount, the term length, and current market conditions. On average, well-qualified borrowers can expect rates between 3-5%, but this can vary significantly.

2. How do I improve my mortgage rate?

To improve your mortgage rate, focus on improving your credit score and reducing your debt. Lenders offer better rates to borrowers who have a high credit score and a low loan-to-value ratio.

3. Should I choose a fixed or adjustable mortgage rate?

If you plan to stay in your home for a long time, a fixed-rate mortgage might be a better choice since it offers stability. If you plan to move or refinance in a few years, an adjustable-rate mortgage could save you money in the short term.

4. Can I negotiate my mortgage rate?

Yes, in many cases, you can negotiate your mortgage rate. Lenders may be willing to offer better terms if you have a strong credit score, a large down payment, or if you’re a loyal customer.

5. How do current economic conditions affect mortgage rates?

Mortgage rates tend to rise when the economy is doing well, as the Federal Reserve increases interest rates to keep inflation in check. Conversely, in times of economic downturn, mortgage rates may fall as the Fed lowers interest rates to stimulate growth.

Conclusion

Finding the best mortgage rates is a critical step in securing a home loan that fits your budget and financial goals. By shopping around, understanding the various factors affecting rates, and staying informed about economic trends, you can maximize your chances of locking in a favorable rate. Whether you choose a fixed-rate or adjustable-rate mortgage, the key is to carefully assess your situation and make informed decisions.

Start researching today to find the best rates and secure your financial future.

:max_bytes(150000):strip_icc()/qAcrl-30-year-mortgage-rate-average-since-october-2023-59f7a7056c6241308ca7b01d5fe6185a.png)