The Ultimate Guide to Money Transfer Services: Choosing the Right Solution for Your Needs

In today’s fast-paced world, money transfer services have become a vital tool for sending money across the globe quickly, securely, and conveniently. Whether you need to send funds to a family member overseas or pay for a service internationally, understanding the various options available can help you make the best choice. This guide will walk you through the best money transfer services, their features, fees, and how to select the right one for your needs.

What Are Money Transfer Services?

Money transfer services allow individuals or businesses to send money from one place to another, typically via electronic transfer. These services have evolved significantly over the years, with a variety of options available ranging from traditional bank wire transfers to mobile payment apps.

The key benefit of money transfer services is their ability to allow for quick and secure transactions, whether you’re sending funds across the country or across the globe.

Key Features of Money Transfer Services:

-

Speed: Most services enable near-instantaneous transfers, although some may take a few days depending on the service and destination.

-

Convenience: Send money online or through mobile apps, eliminating the need to visit a physical location.

-

Security: Most services are highly secure, using encryption and fraud prevention mechanisms to ensure safe transactions.

If you’re interested in online money transfer services, exploring different providers can help you find one that suits your requirements.

Types of Money Transfer Services

There are several types of money transfer services, each offering unique features and benefits. Understanding these options can help you choose the one that aligns with your needs.

1. Bank Transfers

Bank-to-bank transfers are a traditional and reliable method for sending money. They can be used for both domestic and international transfers. Although they tend to be secure, they may not be the fastest option, as they can take a few business days to complete.

2. Online Money Transfer Services

Services like PayPal, Venmo, and Wise offer a convenient way to transfer money online. These platforms typically allow users to link their bank accounts or cards to send money instantly or within a few hours.

3. Mobile Apps

Mobile payment services like Cash App and Zelle allow for quick money transfers through smartphones. These services are increasingly popular due to their ease of use and the fact that they allow for real-time transactions.

4. Money Transfer Agencies

Companies like Western Union and MoneyGram specialize in transferring money worldwide. These agencies usually have physical locations where recipients can pick up their funds, making them ideal for situations where the recipient doesn’t have access to a bank account.

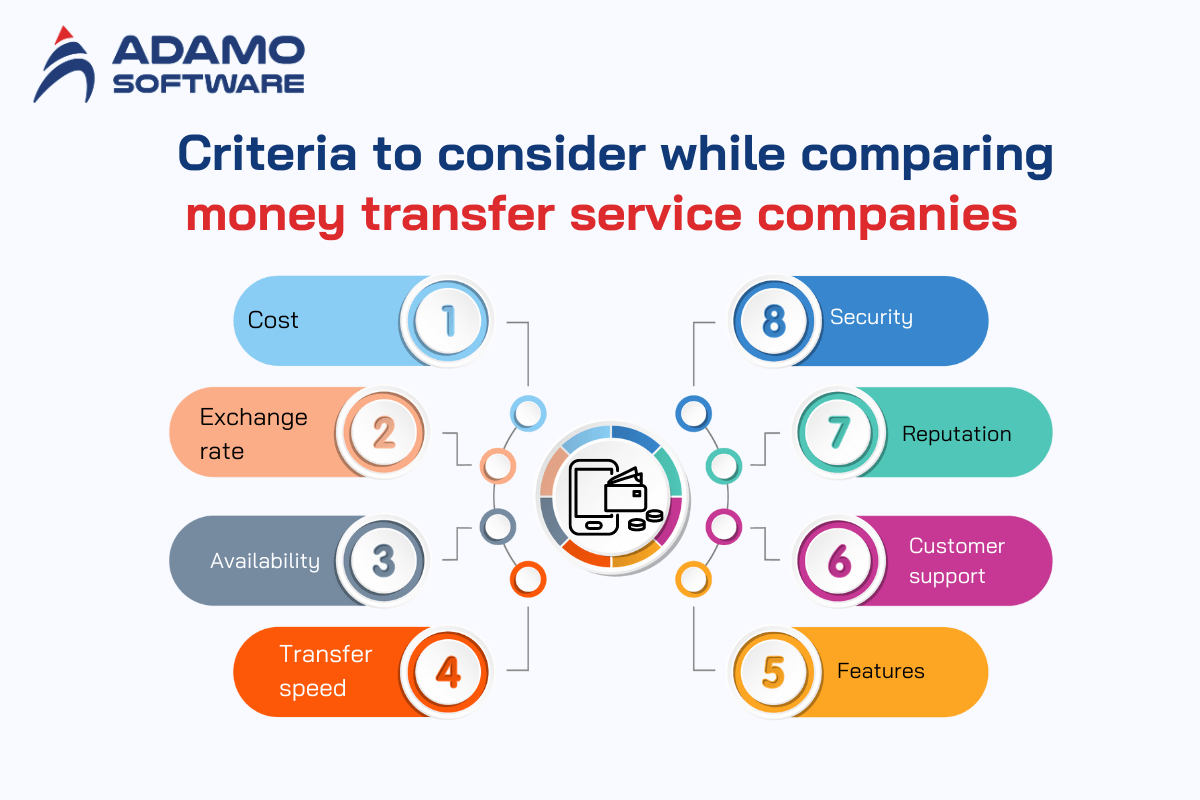

Factors to Consider When Choosing a Money Transfer Service

When selecting a money transfer service, it’s essential to consider several key factors to ensure you’re getting the best deal for your needs.

1. Fees

Different providers charge varying fees based on the transfer method, amount, and destination. For example, online money transfer services may have low or no fees, while agencies like Western Union may charge higher fees for international transfers.

2. Speed

The speed of the transaction is another important factor. While some services offer near-instant transfers, others may take several days. If you need to send money urgently, make sure the service you choose can meet that requirement.

3. Security

It’s crucial to use a secure service to protect your money from fraud. Look for services with encryption and fraud protection policies in place. Most reputable companies offer secure money transfers, but always read the terms and conditions to understand their level of protection.

4. Convenience

Consider how easy it is to use the service. Is it available via an app? Can you make transfers 24/7? Convenience is key, especially if you need to make frequent transfers.

5. Transfer Limits

Some services have limits on the amount of money you can send, which may be important depending on the size of your transaction. Ensure the service you choose accommodates your transfer needs.

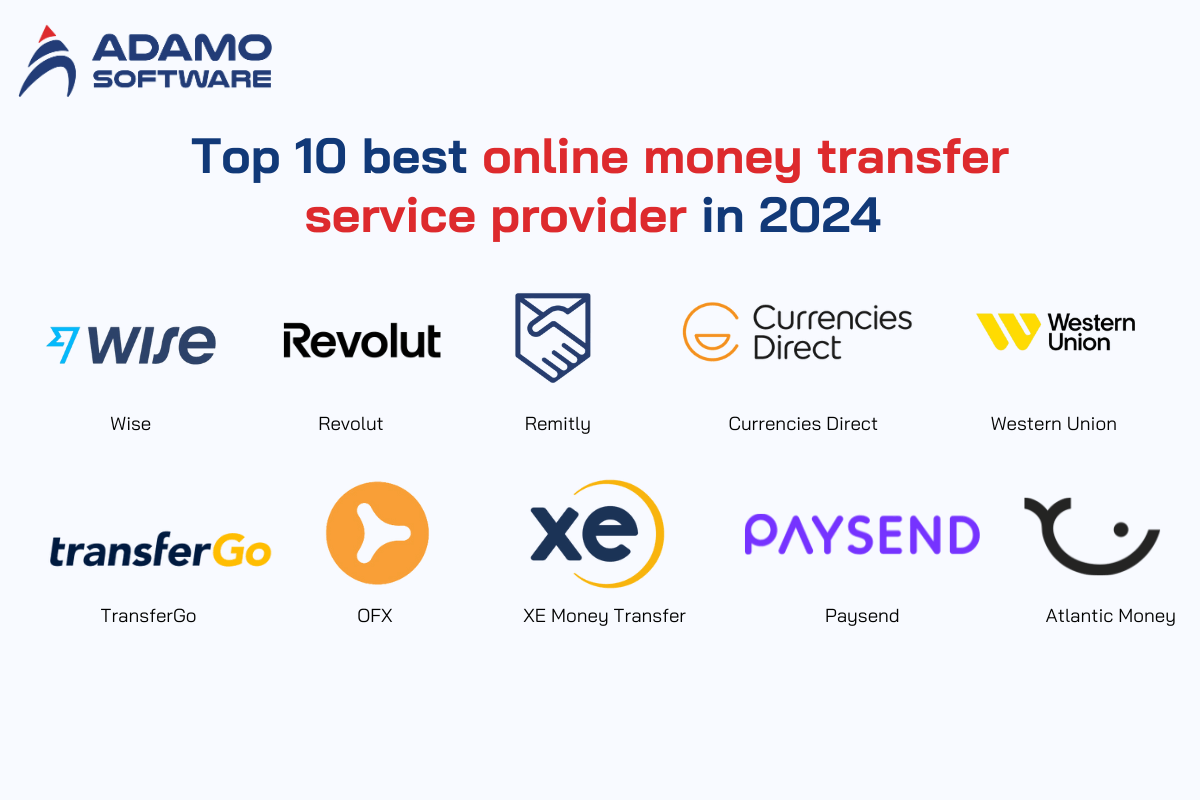

Top Money Transfer Services in 2024

With so many options available, it can be overwhelming to choose the right money transfer service. Here’s a list of some of the best services available today, along with a brief overview of their features:

1. Wise (formerly TransferWise)

Wise is known for its low fees and competitive exchange rates, making it one of the most popular options for international transfers. It allows users to send money to more than 80 countries and offers transparent pricing with no hidden charges.

2. PayPal

PayPal remains one of the most well-known online money transfer services, offering a wide range of payment options. It allows you to send money to friends, family, or businesses with just a few clicks, and it’s a great choice for international transactions.

3. Western Union

Western Union is ideal for those who need to send money to someone who doesn’t have a bank account. It has a global presence and allows users to send cash for pickup at various locations worldwide. It’s a great option for sending money to remote areas.

4. Venmo

Venmo, owned by PayPal, is a mobile payment app popular in the United States. It’s a great choice for sending small amounts of money to friends and family, and it’s often used for personal transactions such as splitting bills.

5. Zelle

Zelle is a fast, easy, and secure way to send money directly from one bank account to another. It’s integrated into many major bank apps, making it a convenient option for domestic transfers.

How to Send Money Using Online Services

Sending money through an online service is generally straightforward. Here’s a step-by-step guide on how to send money using a popular service like Wise or PayPal:

-

Sign Up: Create an account by providing your personal and financial information.

-

Link Your Bank Account or Card: Connect your payment method, such as a debit/credit card or bank account.

-

Enter the Recipient’s Information: Provide the recipient’s details, such as their name and account number.

-

Enter the Transfer Amount: Specify how much money you want to send.

-

Review and Confirm: Double-check the transfer details, including any fees and the expected delivery time.

-

Send the Money: Hit “Send” and track your transaction via the app or website.

Pros and Cons of Using Money Transfer Services

Before choosing a money transfer service, it’s essential to weigh the pros and cons.

Pros:

-

Convenience: You can send money 24/7 from the comfort of your home or mobile device.

-

Speed: Many services offer near-instant transfers, making it ideal for urgent needs.

-

Security: Reputable services offer encryption and fraud prevention to keep your money safe.

Cons:

-

Fees: Some services, especially international ones, may charge higher fees or offer unfavorable exchange rates.

-

Transfer Limits: Some providers impose limits on how much you can send at once.

-

Accessibility: Certain services may only be available in specific regions, limiting your options.

Frequently Asked Questions (FAQs)

1. What is the best way to transfer money internationally?

Services like Wise and PayPal offer the best exchange rates and lower fees for international transfers. These platforms are ideal for both personal and business transactions.

2. Are money transfer services safe?

Yes, most reputable money transfer services have advanced security measures, including encryption, fraud protection, and regulatory compliance to ensure the safety of your funds.

3. How long does a money transfer take?

The transfer time varies depending on the service. Instant transfers are available through platforms like Zelle and Venmo, while international transfers may take 1–3 business days.

4. Can I track my money transfer?

Yes, most money transfer services offer tracking features, allowing you to monitor the progress of your transaction from start to finish.

Conclusion

In conclusion, choosing the right money transfer service depends on your specific needs, whether it’s speed, security, or cost-effectiveness. Whether you’re sending money internationally or domestically, there’s a service that fits your preferences. With options like Wise, PayPal, Venmo, and Western Union, you can find a provider that offers the best balance of convenience, security, and affordability for your transfers.