Money Management Tips: How to Take Control of Your Finances

Managing money effectively is a crucial skill for achieving financial stability and long-term wealth. Whether you’re just starting out or looking to improve your financial habits, understanding money management can make all the difference in your financial success. This article will provide you with practical money management tips that can help you budget smarter, save more, and invest wisely.

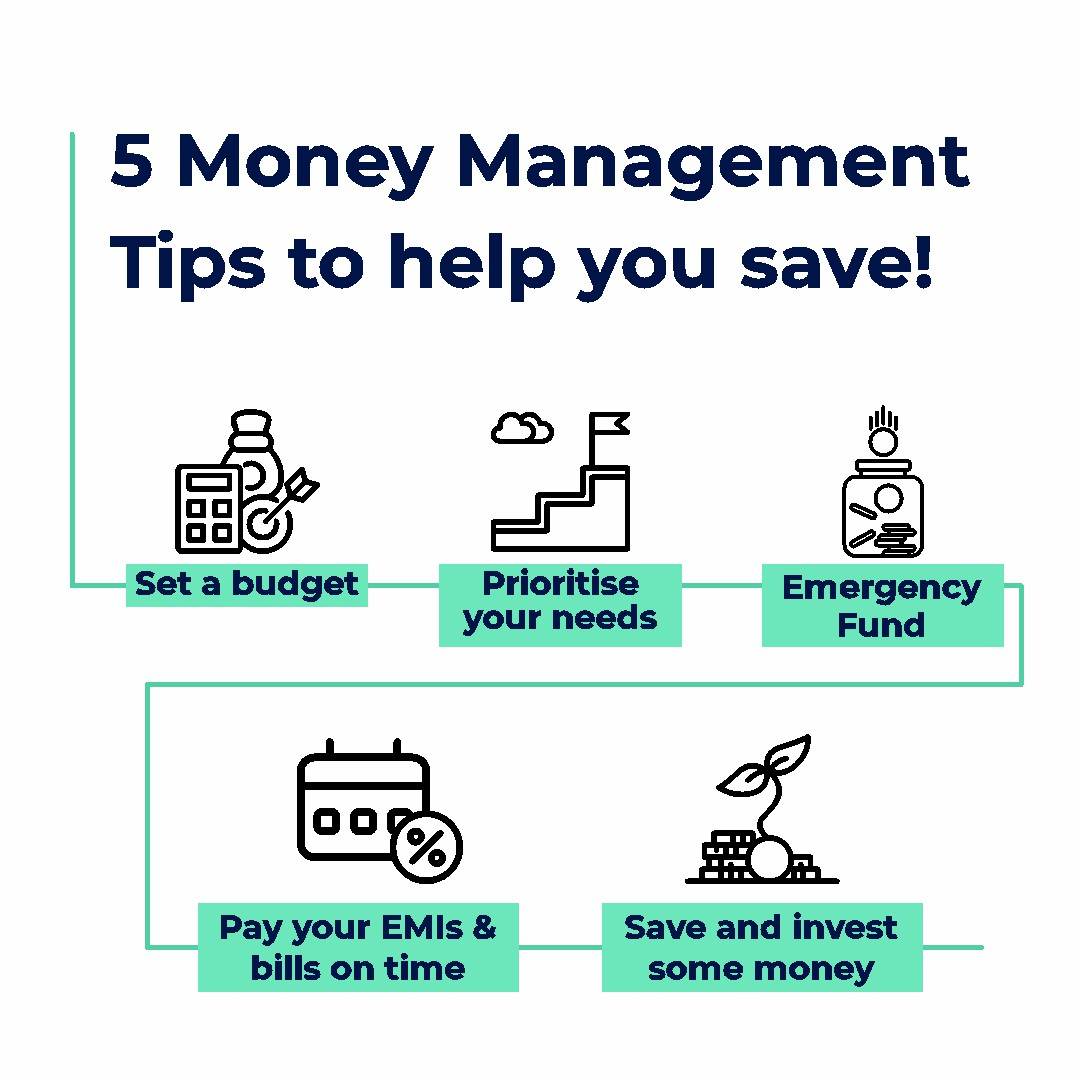

1. Create a Budget and Stick to It

One of the first steps in money management is creating a budget. A budget allows you to track your income and expenses, ensuring that you’re not spending more than you earn. Without a budget, it’s easy to lose track of your spending habits and fall into debt.

Why You Need a Budget:

-

Track Your Expenses: Knowing where your money goes each month helps you make informed decisions about where to cut back.

-

Prevent Overspending: A budget ensures that you only spend on things that matter and avoid impulse purchases.

-

Save for the Future: Budgeting helps you set aside money for your savings and investment goals.

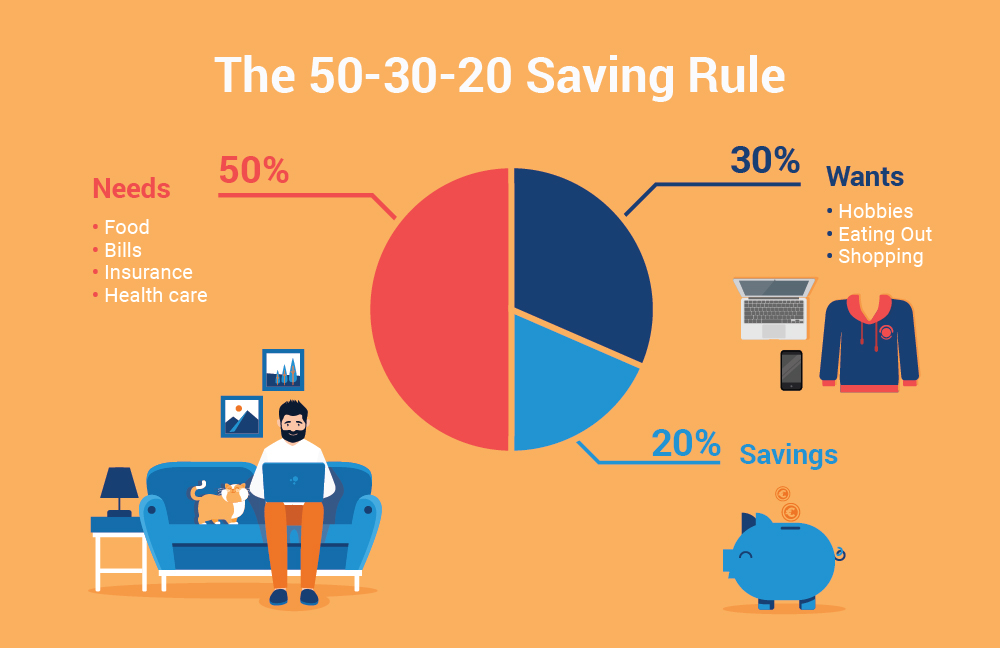

To create a budget, start by listing all your monthly income sources and then record your expenses, categorizing them into needs and wants. Use a simple spreadsheet, or better yet, a budgeting app to keep track of everything. Check out these budgeting tips for a more in-depth look.

2. Build an Emergency Fund

An emergency fund is one of the most important aspects of financial money management. This fund serves as a safety net in case of unexpected expenses, such as medical bills, car repairs, or job loss.

How to Build an Emergency Fund:

-

Set a Goal: Aim for 3 to 6 months’ worth of living expenses.

-

Start Small: If this goal feels overwhelming, start with a smaller amount and gradually increase it over time.

-

Automate Your Savings: Set up automatic transfers from your checking account to your emergency fund to make saving effortless.

Building an emergency fund is not a quick fix, but it’s essential for protecting your financial well-being. Learn how to set up an emergency fund for peace of mind.

3. Pay Off Debt Strategically

Debt can quickly become a financial burden if not managed correctly. Whether it’s credit card debt, student loans, or personal loans, paying off high-interest debts should be a priority.

Debt Repayment Strategies:

-

The Snowball Method: Pay off your smallest debt first and then move on to larger ones. This approach gives you quick wins and helps build momentum.

-

The Avalanche Method: Pay off your highest-interest debt first. While it may take longer to see results, you’ll save more money in the long run.

-

Consolidate Your Debt: If you have multiple debts, consider consolidating them into one loan with a lower interest rate.

By eliminating your debt, you free up more money for saving and investing. Start tackling your debt now and work towards financial freedom.

4. Save for Retirement Early

It’s never too early to start saving for retirement. Retirement savings can seem far off, but the earlier you start, the more you benefit from compound interest. Starting early allows your investments to grow over time, making it easier to reach your retirement goals.

Ways to Save for Retirement:

-

Employer-Sponsored Plans: If your employer offers a 401(k) or similar retirement plan, contribute enough to take full advantage of any matching contributions.

-

Individual Retirement Accounts (IRAs): Consider opening a traditional or Roth IRA to take advantage of tax benefits while saving for retirement.

-

Automate Contributions: Set up automatic contributions to your retirement account so that you’re saving consistently.

Even small contributions early on can make a huge difference by the time you retire. Start saving today, and your future self will thank you! Explore retirement savings options here.

5. Make Smart Investment Choices

Investing is a key component of long-term wealth building. Smart investments can help your money grow, even if you’re not actively managing it. However, it’s important to invest wisely to ensure you’re making the most of your hard-earned money.

Investment Tips:

-

Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes, such as stocks, bonds, and real estate.

-

Start Small: Begin with low-cost index funds or ETFs to minimize risk and exposure.

-

Do Your Research: Before making any investment, research the company or fund thoroughly to understand its potential risks and rewards.

Remember that investing is a long-term strategy, so be patient and avoid making impulsive decisions. Learn more about smart investment strategies for better results.

6. Track Your Net Worth Regularly

Your net worth is a snapshot of your financial health. It’s calculated by subtracting your liabilities (what you owe) from your assets (what you own). Tracking your net worth regularly helps you measure your progress and identify areas where you can improve your money management strategy.

How to Calculate Your Net Worth:

-

List Your Assets: Include savings, investments, real estate, and valuable possessions.

-

List Your Liabilities: Include debts like mortgages, student loans, credit card balances, and personal loans.

-

Subtract Liabilities from Assets: This gives you your net worth.

Tracking your net worth over time allows you to see how much you’ve grown and where you need to focus your efforts. It’s a crucial step in managing your finances effectively.

7. Live Below Your Means

One of the simplest yet most powerful money management tips is to live below your means. This means spending less than you earn and being mindful of your lifestyle choices. By avoiding lifestyle inflation and unnecessary expenses, you can build savings, pay off debt, and invest for the future.

How to Live Below Your Means:

-

Avoid Impulse Purchases: Stick to your budget and avoid buying things you don’t need.

-

Prioritize Needs Over Wants: Focus on essentials and delay gratification for non-essential items.

-

Review Your Subscriptions: Cut out subscriptions you don’t use, such as streaming services or unused memberships.

Living below your means requires discipline, but it’s one of the most effective ways to achieve long-term financial success.

Frequently Asked Questions (FAQs)

1. How Do I Create a Budget That Works for Me?

To create a budget that works, start by tracking your income and expenses for a month. Then, categorize your expenses and make adjustments where necessary. Use tools like budgeting apps or spreadsheets to keep track.

2. How Much Should I Save for an Emergency Fund?

Ideally, you should aim to save 3 to 6 months’ worth of living expenses. This provides a buffer in case of unexpected emergencies, such as medical bills or job loss.

3. What’s the Best Way to Start Investing?

Start by opening a retirement account, such as a 401(k) or IRA, and contribute regularly. From there, diversify your investments across stocks, bonds, and other assets. Do your research and consider low-cost index funds to begin with.

4. How Can I Track My Net Worth?

List all your assets and liabilities and subtract your liabilities from your assets to calculate your net worth. Use tools like personal finance apps to track your progress over time.

Conclusion

Managing money effectively is about making intentional decisions, staying disciplined, and planning for the future. By following these money management tips, you can take control of your financial situation and work towards a more secure and prosperous future. Remember, it’s never too late to start improving your finances. Stay focused, stay disciplined, and take small steps towards big financial success.